In this article, we explore the essential aspects of accounting and tax compliance for non-resident companies in Ireland, and how House of Companies has streamlined and simplified Irish accounting.

We discuss key topics such as corporate income tax, bookkeeping requirements, and the advantages of the Irish tax system. By understanding these critical elements, you can effectively manage your financial affairs and make the most of business opportunities in Ireland’s favorable business environment.

Are you a non-resident company seeking to understand and comply with the accounting and tax requirements in Ireland? We’re here to help! Our Entity Management Service provides the guidance and support you need to ensure your business meets all Irish regulations seamlessly. We recognize that dealing with foreign tax systems can be overwhelming, but with our expertise on your side, you can focus on growing your business while we handle the legalities and compliance details.

Ireland is renowned for its attractive corporate tax system, with a corporate income tax rate of just 12.5%, one of the lowest in the European Union. However, staying compliant with Irish tax laws is key to fully benefiting from these advantages. Our experienced team will assist you in obtaining a VAT registration, preparing and submitting annual financial statements, and ensuring timely payment of corporate tax. We ensure your operations remain fully compliant, so you can take full advantage of Ireland's tax-friendly environment.

Maintaining accurate bookkeeping and financial reporting is vital for ensuring compliance in Ireland. Our specialists will help you align your financial records with International Financial Reporting Standards (IFRS), providing you with transparent and reliable financial statements. We handle all your bookkeeping needs, giving you peace of mind that your financial records are in expert hands.

In Ireland, most businesses are required to have their financial statements audited by a certified auditor. Our Entity Management Service connects you with skilled local auditors who are well-versed in Irish regulations. They will ensure your financial statements are accurate, free from material errors, and fully compliant with Irish law. With our assistance, you can confidently meet audit requirements and maintain your compliance.

Looking to expand your business and increase profitability in Ireland? House of Companies is here to support you with expert guidance on Irish accounting and tax laws. Our entity management service is tailored to help you navigate the Irish business landscape with confidence and success.

At House of Companies, we understand that managing your finances in a foreign jurisdiction can be intimidating. That’s why our expert team is dedicated to offering tailored advice and ongoing support to help you thrive. From VAT registration to the submission of annual financial reports, we ensure your business remains compliant with all Irish tax obligations. Our aim is to allow you to focus on what matters most—growing your business.

A key benefit of partnering with House of Companies is our in-depth knowledge of the Irish tax system. We help you navigate Ireland’s favorable tax rates and business incentives, enabling you to maximize profits and minimize tax burdens. Our comprehensive bookkeeping and financial reporting services ensure your records are consistently accurate and up to date, so you can make strategic business decisions with confidence.

Don’t let the complexities of Irish accounting hold you back. With House of Companies by your side, you can confidently expand your operations and capitalize on the opportunities Ireland offers. Contact us today to learn more about how our entity management service can help you achieve your business objectives.

For any business operating in Ireland, understanding and adhering to local accounting regulations is crucial for ensuring compliance and optimizing operational efficiency. At House of Companies, we specialize in providing personalized entity management services that simplify the complexities of Irish accounting, allowing you to focus on your core business activities and growth.

Ireland offers a highly attractive tax environment, with a corporate income tax rate of just 12.5% on trading income, one of the lowest in the European Union. While this creates great opportunities for businesses, it is important to navigate the intricacies of Irish tax compliance. Companies are required to file annual tax returns and pay taxes on their worldwide income. At House of Companies, we help you understand and meet these requirements, from securing VAT registration to submitting your annual financial statements, ensuring your business stays fully compliant with Irish tax laws.

Accurate bookkeeping and transparent financial reporting are fundamental to maintaining compliance in Ireland. Irish companies must adhere to either the Irish Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), depending on their size and business type. As per the Irish Companies Act 2014, all businesses must maintain proper accounting records and prepare annual financial statements. Our team at House of Companies provides expert bookkeeping and reporting services to ensure your financial records meet regulatory standards, giving you peace of mind and the ability to make informed decisions.

In Ireland, many businesses are required to have their financial statements audited by a qualified auditor. This includes both resident and non-resident companies with substantial operations in Ireland. Under the Companies Act 2014, certain companies must undergo an annual audit. House of Companies connects you with licensed local auditors who possess a thorough understanding of Irish regulations, ensuring your business meets audit requirements without complication.

With House of Companies supporting your business, you can confidently navigate Ireland's accounting and tax landscape, knowing that your compliance and reporting obligations are in capable hands.

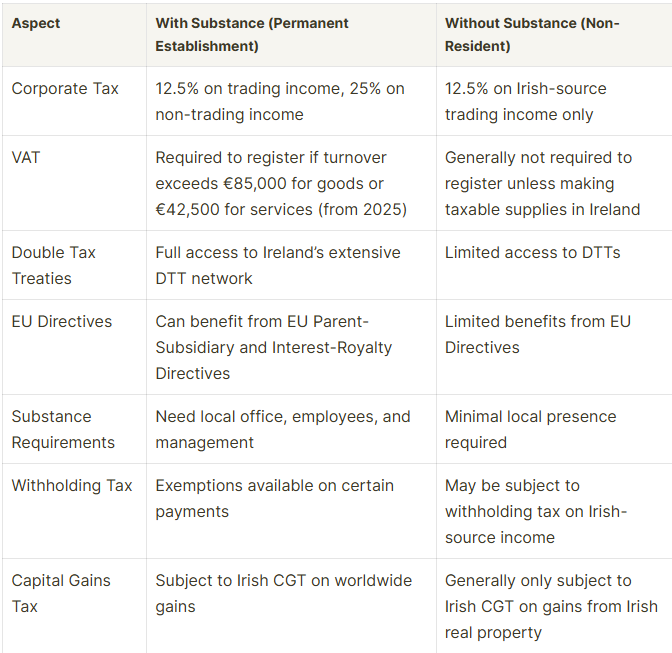

When setting up a business in Ireland, it's essential to understand the distinction between a company with substance (Permanent Establishment) and one without (non-resident). This knowledge plays a significant role in determining your corporate tax obligations and VAT compliance. At House of Companies, we provide comprehensive entity management services, helping you navigate these complexities and make informed decisions that suit your business needs.

An Irish company with substance, also known as a Permanent Establishment (PE), is one that has a physical presence in Ireland, such as an office, employees, or business operations within the country. Companies with substance are subject to corporate income tax at a rate of 12.5% on their worldwide income. Additionally, they must comply with Irish VAT regulations. If the business engages in taxable activities within Ireland, it must register for VAT. The Irish tax authorities outline clear guidelines on what constitutes a PE and the tax responsibilities associated with it.

Conversely, a non-resident company without substance in Ireland is not considered to have a Permanent Establishment. These businesses are only taxed on income derived from Irish sources, meaning they do not face the same corporate tax obligations as Irish-resident companies. Non-resident companies may still need to comply with VAT requirements if they engage in taxable activities in Ireland. However, the VAT obligations differ from those of resident companies, and the thresholds for VAT registration can vary depending on the nature of the business activities.

Choosing the right business structure depends on your goals and the nature of your operations. At House of Companies, we specialize in advising businesses on whether establishing a company with or without substance is the best option. From understanding your tax obligations to ensuring full compliance with local laws, we provide the support you need to make the right decisions for your business's success in Ireland. Let us guide you through the process, so you can focus on expanding your business with confidence.

Ireland offers a variety of legal entity types for non-residents, including Private Limited Companies (Ltd), Branch Offices, and Representative Offices, each with distinct advantages and compliance requirements. At House of Companies, we guide you in selecting the most appropriate entity structure for your business, ensuring that you comply with local regulations while optimizing your operations for success.

A Private Limited Company (Ltd) is one of the most popular choices for non-residents due to its flexibility, limited liability protection, and straightforward registration process. At House of Companies, we assist you in every step of setting up your Irish Ltd company, from preparing necessary documentation to liaising with the local authorities. Our team ensures your registration process is smooth and hassle-free, so you can focus on growing your business in Ireland.

For businesses looking to expand their presence in Ireland without establishing a separate legal entity, a Branch Office or Representative Office may be the ideal solution. These options allow businesses to have a presence in Ireland while maintaining their primary legal structure abroad. House of Companies provides tailored advice on the specific requirements and benefits of each option, ensuring that you make the best decision for your business. Our entity management services are designed to simplify the process and ensure full compliance with Irish regulations.

At House of Companies, we empower non-resident businesses to navigate Ireland’s regulatory landscape with confidence. Our services are designed to meet the unique needs of international clients, offering expert guidance throughout the entity formation process. Let us help you set up your business in Ireland efficiently, so you can concentrate on achieving your strategic objectives.

Establishing a branch office in Ireland can offer significant advantages, such as access to a favorable tax regime and a well-established legal system. However, it’s essential to understand the accounting implications to ensure compliance and fully capitalize on these benefits. At House of Companies, we offer comprehensive Entity Management Services to guide you through the process, providing expert support tailored to your needs.

When registering a branch office in Ireland, it’s crucial to comply with local accounting standards and reporting requirements. Ireland adheres to International Financial Reporting Standards (IFRS), so your branch office will need to prepare financial statements in accordance with these guidelines. Our team of experts helps you navigate these requirements, ensuring that your financial reporting is accurate and timely, reducing the risk of penalties or non-compliance.

House of Companies offers end-to-end support for non-resident businesses, from initial registration to ongoing compliance. Managing a branch office can be complex, but with our expertise, you can focus on expanding your business in Ireland while we handle the details of accounting and regulatory compliance. Trust us to provide the reassurance and guidance you need to ensure a smooth and successful expansion.

Non-resident entities should consult with legal and tax advisors to determine the most suitable option for their situation. House of Companies offers a tailored corporate plan, designed to assist with this process, for a fixed fee of 295 EUR. Let us help you navigate the complexities of establishing and managing a business in Ireland with confidence.

Non-resident entities operating in Ireland must adhere to several tax registration requirements to ensure compliance with Irish regulations. These obligations vary depending on the nature and scope of the business, and may include registering for value-added tax (VAT), payroll taxes, and corporate income tax.

Non-resident businesses engaging in VAT-taxable activities in Ireland are required to register for an Irish VAT number. This requirement applies to both resident and non-resident companies involved in the supply of goods or services (including imports) within the country.

To register for VAT, businesses must submit an application to the Irish Revenue Commissioners, providing relevant documentation such as proof of business incorporation, identification details, and, in some cases, appointing a fiscal representative for non-resident entities.

At House of Companies, we streamline the VAT registration process through our eBranch portal, enabling businesses to quickly and easily obtain their VAT number. Once registered, companies must charge VAT on their taxable supplies, submit periodic VAT returns, and maintain accurate records of their transactions. The standard VAT rate in Ireland is 23%, with reduced rates of 13.5% and 9% applicable to certain goods and services. Failing to comply with VAT obligations can result in penalties, interest on unpaid taxes, and legal consequences.

If your business employs staff in Ireland, you are required to register as an employer with the Irish Revenue Commissioners. This registration is essential for meeting payroll tax obligations, such as withholding and paying social insurance contributions and income tax on behalf of your employees.

The registration process involves submitting an employer registration form to the Revenue Commissioners, along with documentation including proof of business registration and details of your employees. Non-resident companies may also need to appoint a fiscal representative to handle tax matters in Ireland.

Once registered, businesses must withhold income tax from employee wages, contribute both the employer and employee portions of social insurance (PRSI), and submit payroll taxes on a monthly or quarterly basis. Additionally, businesses must keep accurate payroll records and file tax returns on time.

Failure to register as an employer or to meet payroll tax obligations can lead to penalties, interest on unpaid taxes, and potential legal issues. House of Companies provides expert guidance to help businesses navigate employer registration, payroll management, and ongoing tax compliance, ensuring that you meet all Irish tax obligations smoothly and efficiently.

Let us assist you in understanding and fulfilling your tax registration requirements in Ireland, helping you focus on the growth and success of your business.

Understanding your corporate tax liability is essential for resident companies in Ireland aiming to remain compliant and optimize their financial strategy. In Ireland, resident companies are subject to a corporate tax rate of 12.5% on their trading income, making it one of the most attractive tax regimes in Europe for businesses.

This competitive rate, combined with various tax incentives, positions Ireland as a prime location for both new and established companies. At House of Companies, we offer comprehensive support to ensure your company meets all tax obligations efficiently while optimizing your tax strategy.

Our expert team will guide you through the complexities of Irish tax laws, helping you identify and leverage available deductions, credits, and tax reliefs to minimize your corporate tax burden. We assist with accurate tax filings, timely payments, and strategic planning, allowing you to align your tax strategy with your broader business goals. With our proactive approach, we help you avoid penalties and make informed decisions to enhance your company’s profitability.

Maintaining effective bookkeeping and financial reporting is vital for ensuring the financial health and compliance of your business in Ireland. Accurate bookkeeping provides a clear and organized record of all financial transactions, which is essential for monitoring the company's financial position. At House of Companies, our Entity Management Service offers meticulous bookkeeping solutions tailored to your business needs, ensuring your financial records are always up to date and compliant with Irish regulations.

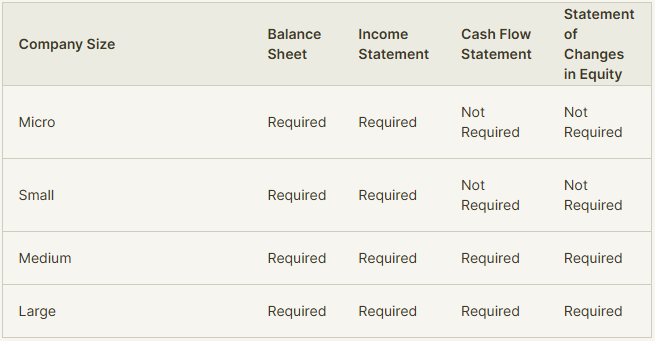

Financial reporting complements bookkeeping by providing insights into your company’s performance and supporting strategic decision-making. Our team of professionals prepares comprehensive financial reports, including balance sheets, income statements, and cash flow statements, to help you gain a clear understanding of your financial standing. These reports not only ensure compliance with Irish regulatory requirements but also help you communicate your company’s financial health to stakeholders and authorities.

By partnering with our Entity Management Service, you can focus on growing your business while we take care of the complexities of bookkeeping and financial reporting. We provide personalized guidance to help you navigate Irish financial regulations, optimize your tax strategies, and ensure your financial data is transparent and accurate.

Tip: No Need to Register a Local Company for Payroll Tax Compliance

In Ireland, you don't need to establish a local company or branch office unless you employ staff directly within the country or outsource employees to third parties. However, if you do have employees in Ireland, you will need to meet specific payroll tax obligations, including income tax and social insurance contributions.

In Ireland, companies that are part of a group may be required to prepare consolidated financial statements. Consolidation involves combining the financial statements of the parent company and its subsidiaries to present a unified set of financial statements that reflect the financial position of the entire group. This ensures a more accurate view of the group's financial health and is vital for both regulatory compliance and transparency.

The requirement to prepare consolidated financial statements generally applies to companies that control one or more subsidiaries. Control is defined as holding more than 50% of the voting rights or having the ability to govern the financial and operating policies of the subsidiary.

Consolidated financial statements must include a balance sheet, income statement, statement of changes in equity, cash flow statement, and notes to the financial statements. These must be prepared in accordance with either Irish Generally Accepted Accounting Practice (GAAP) or, for larger companies, International Financial Reporting Standards (IFRS), depending on the size and nature of the company.

There are exemptions for small and medium-sized groups that meet certain criteria related to size and turnover. These groups may be exempt from the obligation to prepare consolidated financial statements. However, even if exempt, companies may choose to prepare consolidated statements voluntarily for greater transparency and to improve the quality of financial reporting.

Failure to comply with consolidation requirements can result in penalties and affect the credibility of the company’s financial reporting. It is crucial for businesses to understand their obligations and ensure proper consolidation practices are followed.

In Ireland, most companies are required to have their financial statements audited by an independent, licensed auditor. The audit ensures that the company’s financial statements provide a true and fair view of its financial position and comply with relevant accounting standards, such as Irish GAAP or IFRS.

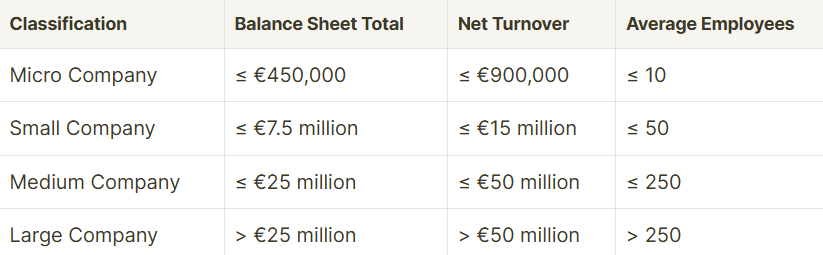

Small and medium-sized enterprises (SMEs) may be exempt from mandatory audits if they meet certain thresholds related to turnover, total assets, and the number of employees. According to Irish regulations, companies that meet at least two of the following three criteria may be eligible for audit exemption:

Even if a company qualifies for the audit exemption, it may still choose to voluntarily undergo an audit for transparency, attracting investors, or enhancing credibility with stakeholders.

Failure to comply with audit requirements can result in penalties and reputational damage. It is essential for businesses to understand their audit obligations and ensure timely compliance with Irish law.

Under Irish company law, financial statements must be approved by the company’s board of directors and filed with the Companies Registration Office (CRO) within a certain period after the end of the financial year. Typically, companies are required to file their financial statements within 9 months of the end of their financial year.

The publication requirements vary depending on the size of the company. Larger companies, including public companies, have more stringent filing and disclosure obligations. In contrast, small companies may be subject to simplified reporting requirements. However, regardless of company size, the filing of financial statements with the CRO is mandatory to ensure compliance with Irish corporate law and transparency for stakeholders.

Non-compliance with publication requirements can result in penalties and legal consequences. It is important for companies to adhere to these deadlines and maintain transparency in their financial reporting.

For businesses unfamiliar with these processes or in need of assistance to ensure compliance with Ireland's consolidation, audit, and publication requirements, House of Companies offers expert guidance tailored to your business’s needs.

In Ireland, companies are required to prepare and file their annual accounts in accordance with the Companies Act 2014, ensuring full compliance with Irish law. These accounts must reflect the true financial position of the company and are typically prepared under Irish Generally Accepted Accounting Principles (Irish GAAP) or, for larger companies, under International Financial Reporting Standards (IFRS).

These accounts must be submitted to the Companies Registration Office (CRO) within 9 months of the end of the company’s financial year. Public and certain large private companies are also required to file their financial statements with the CRO and may need to publish them, either through official gazettes or other media.

Failure to file annual accounts on time can lead to significant penalties, legal consequences, and reputational damage. Therefore, it is essential that all companies ensure timely and accurate filing of their accounts to stay compliant with Irish regulations and maintain transparency.

Under Irish law, most companies are required to have their financial statements audited by a licensed auditor. This audit is crucial for ensuring the reliability and accuracy of the company’s financial records and ensuring compliance with Irish accounting standards, as outlined in the Companies Act 2014.

The audit process includes:

Non-resident entities operating in Ireland must also adhere to specific audit requirements under the Companies Act 2014. These requirements are determined by the size and nature of the entity's operations in Ireland.

Non-resident entities are generally required to have their financial statements audited if their turnover exceeds a certain threshold. The audit must be carried out by a registered auditor in Ireland, and its purpose is to:

In addition to the financial audit, non-resident entities may also undergo compliance audits to ensure they are meeting Irish tax and regulatory requirements, such as VAT, payroll taxes, and employee-related obligations.

Non-resident entities failing to comply with the audit requirements face potential penalties, reputational damage, and legal challenges. To avoid these consequences, non-resident entities should engage a qualified auditor and ensure full compliance with Irish regulations, maintaining transparency and legal integrity in their operations in Ireland.

Non-resident entities operating in Ireland must also adhere to specific audit requirements under the Companies Act 2014. These requirements are determined by the size and nature of the entity's operations in Ireland.

Non-resident entities are generally required to have their financial statements audited if their turnover exceeds a certain threshold. The audit must be carried out by a registered auditor in Ireland, and its purpose is to:

In addition to the financial audit, non-resident entities may also undergo compliance audits to ensure they are meeting Irish tax and regulatory requirements, such as VAT, payroll taxes, and employee-related obligations.

Non-resident entities failing to comply with the audit requirements face potential penalties, reputational damage, and legal challenges. To avoid these consequences, non-resident entities should engage a qualified auditor and ensure full compliance with Irish regulations, maintaining transparency and legal integrity in their operations in Ireland.

Foreign businesses operating in Ireland must comply with the Irish VAT Act 2010 and EU VAT Directive. Non-resident entities conducting taxable transactions or meeting certain thresholds must register for VAT. Businesses can simplify compliance by establishing a local presence, allowing for regular VAT returns and the appointment of a fiscal representative. Alternatively, non-resident businesses can remain non-resident and file quarterly VAT returns, benefiting from the Article 23 exemption that defers VAT payment on imports.

Foreign businesses can also use bonded warehouses, where goods are exempt from VAT and customs duties until released for circulation. To use a bonded warehouse, businesses must obtain approval from Irish Customs and maintain accurate records. VAT and duties are due when goods are released, unless transported to another EU member state under a Customs Transport Permit. Understanding these rules helps businesses manage their VAT obligations and avoid penalties.

For businesses operating in Ireland, understanding the distinction between Irish Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) is essential for accurate and compliant financial reporting. Both frameworks aim for transparency and consistency but have notable differences.

Irish GAAP

Irish GAAP is the accounting framework used by entities operating in Ireland, largely based on EU regulations and the country’s specific legal and accounting requirements. Key features include:

IFRS

IFRS, established by the International Accounting Standards Board (IASB), is globally recognized and aims to standardize financial reporting internationally. Notable features of IFRS include:

Key Differences

Transitioning from Irish GAAP to IFRS

For companies transitioning from Irish GAAP to IFRS, it's critical to adjust accounting policies, especially in terms of asset valuation, revenue recognition, and disclosure practices. Such adjustments help ensure alignment with international standards, providing stakeholders with accurate, transparent, and comparable financial statements.

By understanding these differences, businesses in Ireland can meet their regulatory requirements, optimize their financial reporting, and ensure compliance with the latest standards.

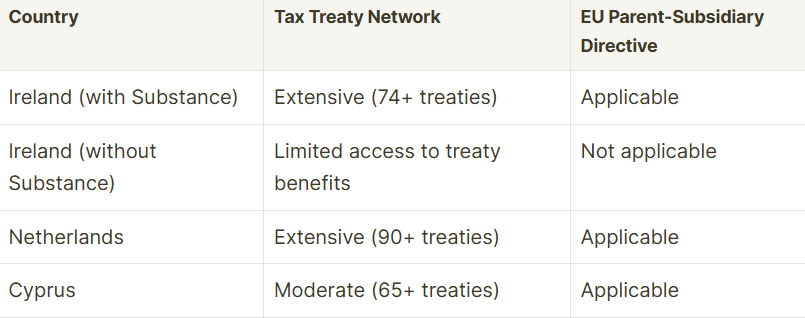

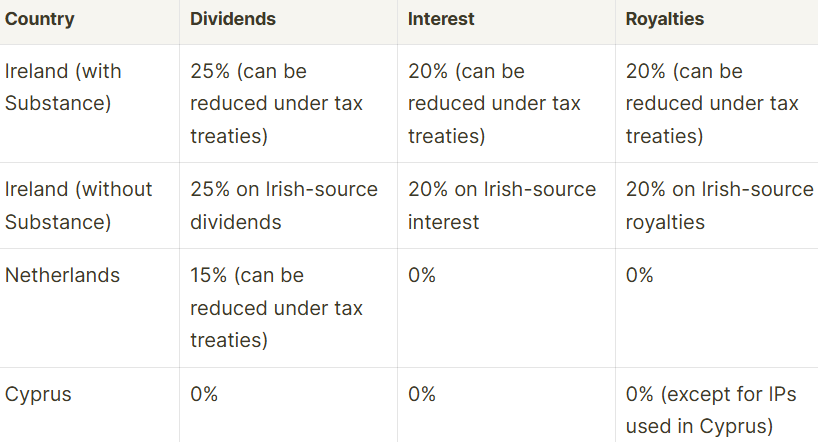

In Ireland, dividends are generally subject to a 25% dividend withholding tax (WHT) when paid to non-resident shareholders. However, there are exemptions available depending on the residency status of the recipient and the applicable tax treaties between Ireland and other jurisdictions. For example, dividends paid to EU resident companies may be exempt from WHT under the EU Parent-Subsidiary Directive, provided certain conditions are met, such as a minimum holding of 5% of the shares in the paying company.

Additionally, Ireland has numerous tax treaties that may reduce or eliminate the withholding tax on dividends paid to recipients in countries with which Ireland has agreements. These treaties are designed to prevent double taxation and may apply specific provisions related to dividends.

A foreign company operating a branch in Ireland is not required to prepare a separate set of Irish financial statements for the branch. However, the parent company must include the branch's financial data in its consolidated financial statements. Since a branch is not considered a separate legal entity, transactions between the parent company and the branch are not subject to withholding tax. This structure allows for simpler tax reporting and no additional WHT on intra-group transactions.

Under Irish law, a parent company is generally required to consolidate the financial results of its subsidiaries in its consolidated financial statements, in line with International Financial Reporting Standards (IFRS) or Irish GAAP. A subsidiary is defined as a company in which the parent company has control—typically, this means holding more than 50% of the voting rights or having the power to appoint a majority of the board of directors. The financial results of these subsidiaries should be included, reflecting their assets, liabilities, revenues, and expenses within the group.

Incoming Dividends: When a parent company receives dividends from a subsidiary, these payments should be recorded as financial income in the parent company's profit and loss account. The amount will also be recorded as a receivable on the balance sheet until the payment is actually received.

Outgoing Dividends: When dividends are paid to shareholders, they should be recorded as a reduction in retained earnings on the balance sheet. The corresponding liability will remain on the balance sheet until the dividend is paid out. This ensures accurate reporting of the distribution of profits and the financial health of the company.

In Ireland, companies are required to submit their annual financial statements and reports to the Companies Registration Office (CRO) and the Revenue Commissioners. The annual return must be filed within 56 days of the company's annual general meeting (AGM). The AGM must be held within 18 months of the company's incorporation and subsequently once every calendar year. Companies are required to prepare their financial statements in accordance with Irish Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), depending on the size and type of the company.

Irish companies must file the following documents annually:

Failure to comply with annual reporting and filing requirements can result in significant penalties, including:

Certain companies in Ireland are required to undergo an annual audit. However, small companies that meet specific criteria, such as having an annual turnover below a set threshold, may be exempt from the audit requirement. The thresholds for exemption are:

If a company exceeds these thresholds, it must have its financial statements audited by a registered auditor in Ireland. Ensuring timely and accurate compliance with annual reporting requirements helps companies avoid penalties and maintain good standing with regulatory authorities in Ireland.

Note: Companies are classified based on meeting at least two of the three criteria (Assets, Turnover, Employees) for their respective size category.

In Ireland, certain small and medium-sized enterprises (SMEs) may be exempt from the requirement to have their financial statements audited. If an SME meets specific criteria, it is not required to have an audit performed by a registered auditor. Instead, these companies can prepare unaudited financial statements, which must still comply with Irish Generally Accepted Accounting Principles (GAAP) or IFRS and be submitted to the relevant authorities.

Small businesses in Ireland may be exempt from the audit requirement if they meet at least two of the following criteria: turnover of less than €12 million, total assets of less than €6 million, and fewer than 50 employees. These businesses can file unaudited financial statements but must still comply with Irish GAAP or IFRS.

If a company does not meet the criteria for the audit exemption, it must have its financial statements audited by a registered auditor. The company will then be required to submit audited financial statements to the Companies Registration Office (CRO) and the Revenue Commissioners.

Yes, even if a company qualifies for the audit exemption, it must still file its financial statements with the Companies Registration Office (CRO) and ensure they comply with Irish accounting standards, whether using Irish GAAP or IFRS.

Failure to comply with audit or filing requirements can result in penalties, including late filing fees, fines, and legal actions. In extreme cases, persistent non-compliance can lead to the company being struck off the register by the Companies Registration Office (CRO).

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!