Ireland offers a streamlined process for business registration, making it an attractive destination for entrepreneurs. With its pro-business environment, low corporate tax rate of 12.5%, and access to the EU market, Ireland is ideal for startups and established companies alike. The registration process can be completed online, ensuring efficiency and convenience. Ireland also provides robust support services, including legal, accounting, and financial advisory, to help businesses thrive. By choosing Ireland, you gain a strategic location, a skilled workforce, and a business-friendly regulatory framework, ensuring your venture's success in the European market.

Embark on your entrepreneurial journey in Ireland with our Entity Management Portal. This innovative platform allows you to explore and acquire existing businesses, providing opportunities that are already established and compliant with Irish regulations.

Whether you’re looking for a successful enterprise or a scalable venture, we simplify the process by managing due diligence, legal compliance, and ownership transfer. Rely on our expertise to help you secure the ideal business opportunity in Ireland, ensuring a smooth and efficient transition into the Irish market.

Ireland offers a competitive corporate tax rate of 12.5%, ideal for businesses aiming to maximize profits.

Located in the Eurozone, Ireland provides direct access to over 450 million consumers across Europe.

Ireland boasts robust government support, funding opportunities, and a skilled, multilingual workforce for global companies.

Setting up a business in Ireland requires compliance with local regulations and precise documentation. We specialize in providing tailored assistance to ensure a smooth registration process. Our services include:

Name Reservation: Ensuring your business name is unique and compliant with the Irish Companies Registration Office (CRO).

Document Preparation: Assisting with Memorandum and Articles of Association, shareholder agreements, and director details.

Tax Registration: Helping you register for Corporation Tax, VAT, and Employer PAYE with the Irish Revenue.

Bank Account Setup: Coordinating with local banks to establish a compliant business bank account.

Post-Incorporation Support: Providing assistance with annual returns and compliance filings.

Legal and Regulatory Guidance: Offering expert advice on Irish business laws and regulatory requirements to ensure full compliance.

Virtual Office Services: Providing a registered office address in Ireland, mail handling, and other virtual office services to enhance your business presence.

Employment and Payroll Services: Assisting with employee contracts, payroll setup, and compliance with Irish employment laws.

Our dedicated team liaises with government agencies like CRO and Revenue to ensure timely and accurate submissions. With a focus on efficiency and compliance, we help you establish your Irish entity with confidence and ease. Additionally, Ireland's favorable business environment, skilled workforce, and strategic location within the EU make it an ideal choice for entrepreneurs looking to expand their operations. By choosing our services, you benefit from our extensive experience and commitment to your business success in Ireland.

Forming an entity in Ireland has never been easier with our efficient and fully online services. Ireland, known for its favorable business environment and low corporate tax rate, offers an ideal location for entrepreneurs. Our platform simplifies the entire process, from name reservation and document preparation to tax registration and bank account setup. We ensure compliance with Irish regulations, providing legal and regulatory guidance, virtual office services, and post-incorporation support. Benefit from Ireland's strategic EU location and skilled workforce while we handle the complexities, allowing you to focus on growing your business.

Ireland stands out as a prime beneficiary of our streamlined online business registration process. Entrepreneurs can effortlessly set up their businesses, taking advantage of Ireland's favorable corporate tax rate of 12.5% and its strategic location within the EU. Our online platform ensures compliance with the Irish Companies Registration Office (CRO) and the Irish Revenue, simplifying name reservation, document preparation, and tax registration. Additionally, our services include bank account setup and post-incorporation support, ensuring a smooth transition for businesses. By choosing Ireland, you gain access to a skilled workforce, a pro-business environment, and robust support services, making your entrepreneurial journey seamless and efficient.

Establishing a business in Ireland has never been easier with our efficient online services. We provide comprehensive support to ensure your company is set up quickly and in full compliance with Irish regulations. Our services include name reservation, document preparation, tax registration, and bank account setup. Additionally, we offer post-incorporation support and virtual office services. With our expert guidance, you can navigate the Irish business landscape effortlessly, taking advantage of Ireland's favorable tax rates, skilled workforce, and strategic EU location. Start your entrepreneurial journey in Ireland with confidence and ease.

Navigating bureaucracy in Ireland can be seamless with the right support. Our expert team specializes in handling all administrative tasks efficiently, ensuring compliance with Irish regulations. From company registration and tax filings to obtaining necessary permits and licenses, we streamline the process, saving you time and effort. With our comprehensive services, you can focus on growing your business while we manage the paperwork. Trust us to simplify your bureaucratic journey in Ireland, ensuring smooth and hassle-free operations.

Navigating the legal and compliance landscape in Ireland can be challenging, but our cost-effective services make it easier. We provide expert guidance on Irish business laws, ensuring your company meets all regulatory requirements. Our comprehensive support includes document preparation, tax registration, and ongoing compliance management. By leveraging our expertise, you can focus on growing your business while we handle the complexities of legal and regulatory compliance. Trust us to deliver efficient, affordable solutions tailored to your needs, helping you thrive in Ireland's dynamic business environment.

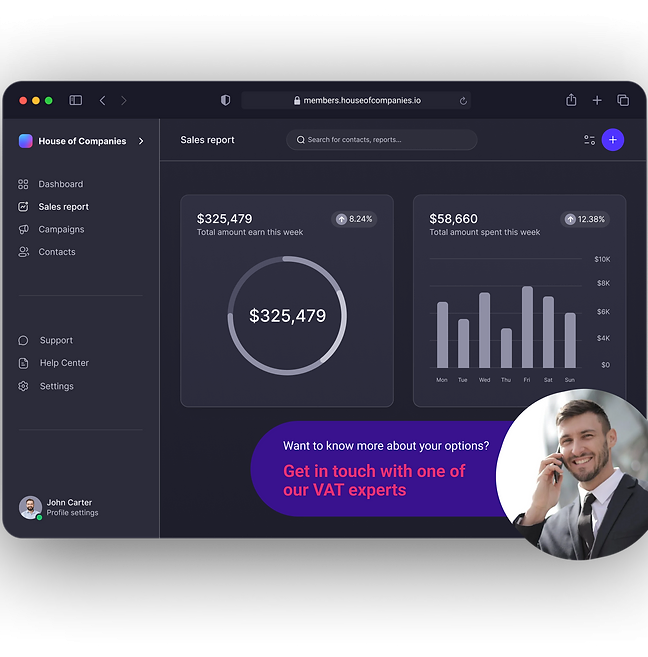

Reducing operational costs in Ireland can significantly enhance your business's profitability. Leveraging Ireland's favorable tax regime, including the 12.5% corporate tax rate, is a key strategy. Additionally, utilizing government incentives and grants for innovation and research can lower expenses. Outsourcing non-core activities to local service providers can also reduce overheads.

Embracing digital transformation and automation streamlines processes, further cutting costs. By optimizing resource allocation and taking advantage of Ireland's skilled workforce, businesses can achieve substantial savings and maintain competitive advantage.

Setting up an entity in Ireland involves specific documentation and compliance with local regulations. Key requirements include a unique business name approved by the Irish Companies Registration Office (CRO), Memorandum and Articles of Association, shareholder agreements, and director details. Additionally, businesses must register for Corporation Tax, VAT, and Employer PAYE with the Irish Revenue.

Opening a compliant business bank account and maintaining a registered office address in Ireland are also necessary. Ensuring all documents are accurately prepared and submitted is crucial for a smooth and successful establishment of your Irish entity.

"Incredible service! Business registration in Spain was a breeze thanks to their expert guidance and Entity Management services. They took care of everything from start to finish."

Carlos M

Carlos M"Efficient, professional, and seamless. They made registering my business in Spain easy. Their Entity Management services were essential in keeping everything organized."

Sofia R

Sofia R"Absolutely recommend their services. Business registration in Spain felt effortless with their assistance, and the Entity Management services kept everything running smoothly."

David G

David GLooking to register a business in Ireland? Ireland offers a streamlined and efficient registration process, making it an ideal destination for entrepreneurs. With a low corporate tax rate of 12.5%, access to the EU market, and a supportive business environment, Ireland is perfect for startups and established companies alike. Our comprehensive services include name reservation, document preparation, tax registration, bank account setup, and post-incorporation support. Benefit from our expertise and ensure your business complies with all Irish regulations, allowing you to focus on growth and success in the European market.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!