Our new office in Ireland offers exceptional accounting services tailored to Irish companies. We specialize in tax filing and financial reporting, ensuring all aspects of your financial management are handled with precision.

With our local expertise, we deliver fast and accurate financial reporting that complies with Irish regulations. We manage your tax filings, taking the stress of local tax laws off your plate. Our focus on compliance and reporting allows you to concentrate on growing your business.

Both local and international businesses operating in Ireland receive personalized service, backed by our deep industry knowledge. We combine expert insight with a personal touch to provide unparalleled support. Let our team of specialists manage your finances so you can focus on achieving your corporate goals.

Automated OSS filing for import traders and e-commerce.

Close your fiscal year and generate financial statements with a click!

Ready to expand into Ireland and beyond? Run and build your business!

Ready to branch out to Ireland and beyond? Manage your entity and your growth!

Handling invoices, bank statements, and agreements (like your lease) is now more streamlined than ever. The House of Companies enhances your experience by offering a central hub for all your documents, data, and reports.

With our system, you can effortlessly track your business’s progress and monitor profits in real time, ensuring smooth and efficient operations in Ireland!

Ireland's accounting regulations are designed to ensure transparency and financial accountability within businesses, making it essential for companies operating in the country to fully understand and comply with these standards. The Irish accounting framework follows the Irish Generally Accepted Accounting Principles (GAAP), which provide clear guidelines for financial reporting and disclosure.

Key aspects of Irish accounting regulations include the requirement for companies to maintain precise and up-to-date financial records, prepare annual financial statements, and file them with the Companies Registration Office (CRO). These statements must comply with the legal format specified in the Companies Act, ensuring that they reflect a true and accurate view of the company’s financial health.

For businesses operating in Ireland, our entity management services offer comprehensive support to ensure full compliance with these regulations. We assist with bookkeeping, the preparation of financial statements, and timely compliance reporting, ensuring our clients meet their obligations seamlessly and accurately. Our in-depth expertise in Irish accounting practices allows companies to focus on growth and core operations while we manage the intricacies of financial compliance.

For corporate tax purposes, an Irish company with substantial operations, meaning it has a permanent establishment (PE) in Ireland, is subject to corporate income tax (CIT) on its global income. In contrast, a non-resident company without a PE in Ireland is only liable for CIT on income sourced from Ireland, such as profits from a PE or income derived from Irish real estate.

The term "permanent establishment" is defined in Irish tax law and generally aligns with the definition in the tax treaties Ireland has signed with other countries. In situations without a treaty, the definition usually follows the guidelines established in Article 5 of the OECD Model Convention.

When it comes to value-added tax (VAT), an Irish company with substantial operations must register for VAT and charge VAT on the sale of goods and services.

A non-resident company without a PE in Ireland may still need to register for VAT if it makes taxable supplies in Ireland, such as distance sales or e-services to Irish consumers.

In conclusion, the presence of a permanent establishment is key in determining a company's corporate tax and VAT obligations in Ireland, as it impacts the scope of tax liabilities in the country.

Non-resident entities looking to establish a presence in Ireland have several legal entity options, each with distinct accounting and tax implications. The most common choices include branch offices, subsidiaries, and foreign legal structures.

A branch office, often referred to as a permanent establishment (PE), is an extension of the foreign company and is not considered a separate legal entity. It must be registered with the Irish Companies Registration Office (CRO) and is subject to Irish corporate income tax and value-added tax (VAT) on profits attributable to the branch. While a branch office does not need to file separate financial statements in Ireland, the parent company’s financial statements must be submitted.

On the other hand, subsidiaries are independent legal entities incorporated under Irish law. They must be registered with the CRO, file annual financial statements, and comply with all Irish tax obligations, including corporate income tax, VAT, and payroll taxes. Subsidiaries provide greater administrative simplicity and operational autonomy than branch offices.

Foreign companies may also choose to use their own home country’s legal structure when setting up in Ireland. Irish company law accommodates most foreign business structures, except sole proprietorships. However, opting for a foreign legal structure can add complexity, especially when dealing with multiple tax authorities across both Ireland and the home country.

Registering a branch office in Ireland comes with several key accounting and compliance obligations. The branch must maintain accurate records and books in line with Irish accounting standards. Additionally, the foreign company's financial statements need to be filed with the Irish Companies Registration Office (CRO), ensuring transparency and legal compliance.

If the branch employs staff, it is mandatory to set up an Irish payroll system. This includes withholding income tax (PAYE), social insurance contributions (PRSI), and other applicable deductions, ensuring full compliance with Irish labor laws.

Profits generated by the branch are subject to Irish corporate income tax, which is one of the lowest in the EU, at a standard rate of 12.5%. The branch is also required to file VAT returns on a regular basis, typically quarterly or annually, depending on its revenue. Furthermore, transfer pricing rules govern transactions between the branch and its foreign parent company, demanding that the allocation of profits be well-documented and compliant with Irish regulations.

When deciding whether to set up a branch, subsidiary, or opt for an alternative structure, several factors must be considered. These include the scope of business activities in Ireland, tax implications, and the level of administrative burden. It’s essential for non-resident entities to consult with local legal and tax experts to ensure the optimal structure for their business operations in Ireland.

Non-resident entities conducting business in Ireland must adhere to a range of tax registration requirements to stay compliant with local regulations. Depending on the scope and scale of their operations in Ireland, they must register for Value-Added Tax (VAT), corporate income tax, and payroll taxes. Ensuring proper registration and timely compliance will help businesses navigate Ireland's tax system effectively while avoiding penalties.

Navigating VAT regulations is essential for businesses engaged in VAT-taxable transactions in Ireland. With Ireland’s standard VAT rate set at 23%, businesses must ensure they are properly registered for VAT, submit accurate tax filings, and make timely payments to stay in full compliance with local tax laws.

Our entity management services in Ireland provide comprehensive support for businesses handling VAT. From seamless VAT registration to managing returns and compliance, our expert team is committed to offering dedicated assistance, ensuring your business operates in full accordance with Ireland’s VAT regulations efficiently and without disruption.

When establishing a business in Ireland, one of the essential steps is registering as an employer if you intend to hire and manage employees. This registration ensures full compliance with Irish labor laws, including tax, social security, and other employment-related obligations.

Our entity management services in Ireland are specifically designed to streamline the employer registration process for businesses. From obtaining the necessary employer registration numbers to ensuring you meet all payroll obligations, we take care of the legal and regulatory details. With our expert team handling these vital tasks, you can focus on growing your business, confident that your compliance needs are in expert hands.

In Ireland, resident companies are subject to corporate income tax (CIT) on their worldwide income. The standard CIT rate in Ireland is one of the most competitive in Europe, set at 12.5%. This rate applies to most trading income, making Ireland an attractive location for businesses seeking to optimize their tax obligations. Additionally, certain activities, such as intellectual property and specific asset management, may benefit from a 25% rate, ensuring companies can plan their tax strategy effectively.

Non-resident companies are taxed only on their Irish-source income, which typically includes profits generated through a permanent establishment or business operations within Ireland. These companies are required to file annual CIT returns and pay tax on income derived from their Irish activities.

To remain compliant with Ireland's tax system, non-resident companies should engage with local tax experts or legal consultants. These professionals can guide them through the local tax landscape, ensuring that they meet deadlines, optimize deductions, and avoid penalties for non-compliance. Keeping up to date with the latest tax regulations is essential to maintaining a positive relationship with the Irish tax authorities and optimizing tax efficiency.

In Ireland, resident companies are subject to corporate income tax (CIT) on their worldwide income. The standard corporate income tax rate is 12.5%, which is one of the lowest in Europe, making Ireland an attractive destination for businesses. Additionally, a higher rate of 25% applies to certain types of income, such as income from non-trading activities or passive income like investment profits.

Companies operating in Ireland must file annual corporate income tax returns and make advance payments throughout the year based on their expected taxable income. The Irish tax authority, Revenue, monitors these returns to ensure timely compliance.

For non-resident companies, corporate income tax applies only to Irish-source income. This includes profits derived from a permanent establishment in Ireland or other taxable Irish activities. These companies must also file corporate income tax returns for the income generated within the country and pay taxes accordingly.

Non-resident entities operating in Ireland are required to adhere to various bookkeeping and financial reporting obligations as stipulated by Irish law. The financial reporting framework is primarily governed by the Irish Companies Act and the Irish Generally Accepted Accounting Principles (Irish GAAP), though entities can also choose to follow International Financial Reporting Standards (IFRS) for larger businesses or public interest entities.

Nearly all Irish corporate entities must prepare financial statements in accordance with the Companies Act. These financial statements play a central role in corporate governance and are essential for determining tax obligations. They provide the foundation for accurate tax assessments, although tax laws may differ slightly from accounting principles.

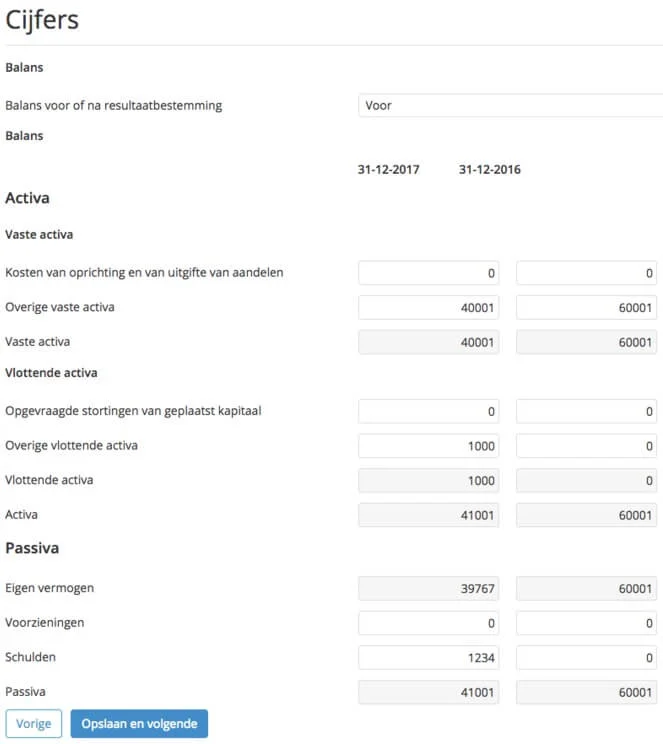

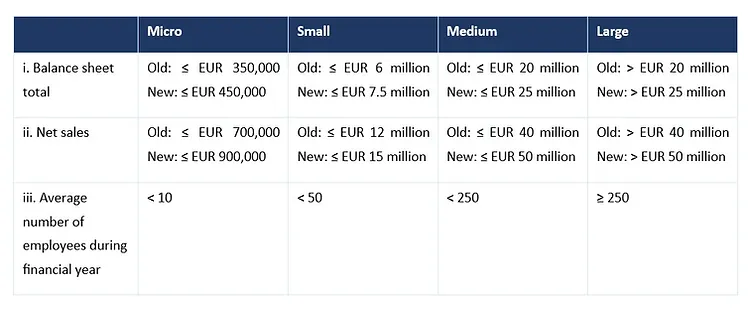

Depending on the company's size and applicable legal requirements, the financial statements typically include the following:

The financial statements must fairly represent the company’s financial position. The accounting principles employed must be clearly stated, and any changes to these principles, including the impact on the company’s financial standing, must be disclosed in the notes.

Ireland places significant importance on transparency, with robust regulations ensuring that businesses operate within a well-regulated financial framework. This commitment to financial accuracy supports corporate governance and tax compliance, ensuring that both resident and non-resident businesses can thrive in a stable and attractive business environment.

Ireland's consolidation standards are integral to the effective management of corporate entities, ensuring businesses align with local financial and regulatory frameworks. These standards uphold transparency and precision in financial reporting for companies operating in the country.

Our entity management services in Ireland are specifically designed to guide businesses through the nuances of consolidation requirements. We offer customized support for financial reporting, group consolidation, and regulatory compliance, ensuring businesses meet their obligations with ease. By focusing on Ireland’s distinct legal environment, we help companies operate smoothly, stay compliant, and redirect their focus toward growth and success.

In Ireland, it is mandatory for medium and large companies, as well as those adhering to IFRS (International Financial Reporting Standards), to have their annual financial statements audited by an independent and registered auditor. The auditor’s report must confirm that the financial statements comply with Irish accounting standards and accurately reflect the company’s financial health and performance for the year. This audit ensures transparency and accountability, providing stakeholders with confidence in the financial reporting process.

In Ireland, publication requirements are crucial for businesses to maintain compliance with local regulations. As part of our entity management services, we understand the importance of adhering to these requirements to ensure transparency and legal integrity.

In Ireland, businesses must file certain documents with the Companies Registration Office (CRO) to meet their publication obligations. These documents typically include the company's constitutional documents, annual financial statements, and any significant changes to the corporate structure. Fulfilling these publication requirements is key to ensuring a company remains in good standing with regulatory authorities and strengthens trust with clients and stakeholders.

Our services are tailored to assist businesses in Ireland with all aspects of publication compliance. We offer end-to-end support, ensuring companies accurately prepare and submit the necessary documents on time. Our dedicated team allows businesses to focus on growth and operational efficiency while we manage the complexities of compliance in the Irish market.

Under Irish law, almost all corporate entities must prepare financial statements in compliance with their statutory obligations, which are vital to Ireland's legal and corporate governance framework. These financial statements are also essential for taxation purposes, as they form the foundation for determining taxable income, although specific tax regulations may introduce additional rules.

The structure of financial statements depends on the company’s size and its publication requirements. Generally, they should include a balance sheet, an income statement, and explanatory notes. These documents must accurately reflect the company's financial standing, and any significant changes in accounting policies must be disclosed in the notes to ensure transparency.

For parent companies, there is an obligation to include the financial data of "controlled subsidiaries" and other "group companies" in their consolidated financial statements. However, consolidation can be waived under certain conditions. For instance, a subsidiary or group company may be excluded if it qualifies as a small company under Irish statutory criteria or if its financial details are already incorporated in the parent company's consolidated financial statements prepared in line with relevant accounting standards.

Online bookkeeping services have become crucial for businesses in Ireland seeking to simplify their financial processes. These services offer a wide range of solutions designed to meet the needs of both startups and established enterprises. By utilizing advanced technology and professional expertise, online bookkeeping providers ensure accurate financial reporting and effective management of financial data. This helps businesses stay compliant with local regulations and empowers them to make well-informed decisions, enhancing overall operational efficiency in Ireland's dynamic business environment.

Our Ireland branch is dedicated to delivering high-quality online bookkeeping services, customized for businesses thriving in Ireland's dynamic marketplace. With in-depth knowledge of Irish financial regulations and accounting standards, we ensure your bookkeeping remains precise, efficient, and fully compliant.

Our skilled team harnesses advanced technology to offer seamless, efficient bookkeeping solutions, allowing businesses to focus on scaling and strategic goals. From meticulous transaction tracking to detailed financial reporting, our services cover all aspects of bookkeeping tailored to meet the specific requirements of Irish companies.

Choosing our online bookkeeping services means gaining real-time financial insights and expert support, empowering you to stay proactive and informed in managing your business finances. We’re committed to building lasting partnerships with Irish businesses, supported by exceptional service and dedicated expertise in the Irish market.

Virtual bookkeeping services in Ireland offer various pricing options tailored to meet different business needs, ensuring efficient and budget-friendly financial management. Here’s a breakdown of common pricing models and what businesses should consider:

Hourly Rates: This traditional model charges based on the time spent managing financial tasks, ideal for businesses with occasional bookkeeping needs. It's straightforward and flexible, allowing companies to pay only for the hours they require.

Monthly Subscription Fees: For businesses needing consistent support, a monthly fee provides predictable costs and a clear financial plan. This model is excellent for companies that prefer regular, ongoing bookkeeping without the concern of fluctuating expenses.

Project-Based Pricing: With project-based pricing, businesses are charged for specific tasks or projects, allowing tailored solutions based on the complexity and scope of each task. This is well-suited for businesses that need specialized or irregular bookkeeping assistance.

Value-Based Pricing: Instead of focusing on time spent, this model centers on the outcomes and value delivered to the client. It's designed to reflect the benefits and insights gained, often appealing to businesses looking for strategic financial guidance alongside traditional bookkeeping.

Factors Influencing Pricing in Ireland: The cost of virtual bookkeeping can vary depending on the service scope, level of expertise required, and customization of the services. The geographic location and specific requirements of the business also play a role, as do the complexity and frequency of bookkeeping tasks.

For a transparent experience, businesses should look for providers with clear pricing plans and no hidden fees. Choosing a provider with scalable pricing options can also be beneficial as it allows easy adjustments to services and costs as the business grows or its needs shift.

Our online bookkeeping services in Ireland are tailored to meet the unique needs of businesses thriving in this dynamic market. With a firm grasp of Irish regulations and financial practices, we deliver solutions that simplify financial management and boost operational performance.

Compliance with Confidence: We ensure full alignment with Irish accounting standards and tax requirements, helping businesses avoid fines and stay confidently compliant.

On-Demand Financial Access: Access your financial information anytime, from anywhere, with our secure online platform—empowering timely decision-making and strategic growth.

Personalized Financial Insights: Our tailored reporting provides businesses with clear, actionable insights, highlighting performance metrics and growth areas specific to their operations.

Dedicated Support Team: Our Irish bookkeeping experts are ready to support your business with industry knowledge and expertise, ensuring your financial needs are well-managed in Ireland's competitive business environment.

Seamless Software Integration: Our services easily connect with popular accounting software, allowing businesses to maintain smooth workflows without disruption to their existing systems.

With our online bookkeeping services, businesses in Ireland gain a trusted partner in managing finances, enabling them to focus on growth, streamline operations, and drive success with peace of mind.

Value-Based Pricing: Fees reflect the true value of services provided rather than billable hours, ensuring that Irish businesses receive impactful solutions aligned with the service's value and importance.

Tiered Packages: Choose from basic, standard, and premium packages designed to meet diverse business needs and budgets, allowing flexibility for companies at various stages of growth.

Customized Pricing: Tailored pricing models are crafted to address the unique needs of different industries, ensuring each client benefits from solutions that directly serve their sector-specific requirements.

This adaptable pricing model allows businesses across Ireland to access expert services that meet both their budget constraints and specific operational needs.

Irish bookkeepers with industry-specific expertise offer a powerful suite of services designed to tackle the unique demands of each sector:

With the rise of technology-driven finance in Ireland, bookkeepers have access to AI-powered software, cloud solutions, and automation, which boost productivity and reduce costs. This approach to industry-focused bookkeeping allows Irish businesses to stay competitive, compliant, and future-ready.

Virtual bookkeeping assistants are quickly becoming a vital resource for businesses in Ireland aiming to optimize their financial management. These skilled professionals provide remote support, seamlessly managing everything from financial records to transaction tracking and reporting. Leveraging advanced accounting software, virtual bookkeeping assistants in Ireland handle data entry, reconciliations, payroll processing, and expense tracking with accuracy and efficiency. Their expertise enables businesses to keep precise financial records, conserve valuable time, and cut down on costs, making them a smart, flexible solution for small businesses and larger companies alike in the Irish market.

Virtual bookkeeping assistants in Ireland bring valuable expertise to financial management, with a deep understanding of Irish accounting standards and a knack for leveraging cloud-based accounting tools. These skilled professionals excel in tasks like managing balance sheets, preparing income statements, optimizing financial resources, and delivering customized financial reports. Their ability to work effectively with a range of stakeholders—clients, senior management, and regulatory bodies—enables them to navigate Ireland’s business landscape with ease.

With years of industry experience, many Irish virtual bookkeeping assistants offer insights shaped by long-standing expertise, some with over a decade in the field. Regular training keeps them updated on the latest Irish accounting standards, tax regulations, and compliance requirements, ensuring businesses receive accurate, compliant, and tailored financial support specific to Ireland’s market. Whether supporting startups or established firms, these virtual assistants provide a reliable backbone for financial health and compliance.

The cost of hiring a virtual bookkeeping assistant in Ireland varies widely depending on factors like expertise, experience, and the complexity of tasks involved. Common pricing models include hourly rates, fixed monthly retainers, and project-based fees. Hourly rates for virtual bookkeeping assistants in Ireland generally range from €20 to over €70, with more experienced assistants and specialized services on the higher end of this range.

For businesses that require ongoing support, many virtual bookkeeping services in Ireland provide monthly subscription plans. These packages often come in tiered options, allowing businesses to select a service level that aligns with their needs and budget. Some providers offer flat-rate packages for a set number of hours each month, creating a predictable expense structure.

In some cases, companies may also consider virtual bookkeeping assistants based in lower-cost countries, such as India or the Philippines, which can provide similar services at more competitive rates. However, Ireland-based assistants typically offer a deeper understanding of Irish tax laws and financial regulations, which can be critical for compliance and local reporting needs.

Virtual bookkeeping assistants in Ireland can provide a range of valuable services, including:

These services help Irish businesses keep their financial records accurate, meet tax compliance requirements, and gain insights that drive smarter business decisions. For companies in Ireland, a virtual bookkeeping assistant offers an efficient, flexible way to manage finances without the need for a full-time in-house team.

The cost of hiring a virtual bookkeeping assistant in Ireland varies widely, influenced by factors such as experience, expertise, and task complexity. Many providers in Ireland offer flexible pricing models: hourly rates, fixed monthly packages, or project-based fees. Hourly rates for Irish virtual bookkeeping assistants typically range from €20 to over €70, depending on skill level and the scope of services.

For businesses needing consistent, ongoing support, monthly subscription plans are a popular choice. These are often structured in tiers, enabling companies to choose a plan that aligns with their budget and service needs. Flat-rate packages are available for a set number of hours per month, providing predictable costs and tailored service levels.

Many businesses in Ireland also explore virtual assistants based outside of the country, in areas with a lower cost of living, to benefit from lower rates without sacrificing service quality.

Irish virtual bookkeeping assistants provide a suite of services designed to help businesses stay financially organized and compliant with local regulations. Common services include:

These services empower Irish businesses to maintain precise financial records, ensure tax compliance, and gain data-driven insights for better decision-making.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!