Looking to launch a business in Ireland but feel that traditional company formation processes are too slow? House of Companies offers expedited company registration services. For those in urgent need or seeking a pre-established entity with a track record, we provide Shelf Companies in Ireland to get you operational without delay.

Are you planning to expand internationally by acquiring a ready-made company? International growth can be complex and costly, but our Entity Management Platform simplifies the process! Ireland, along with many other jurisdictions, enables you to register your existing legal structure as a branch or purchase a fully registered company to accelerate your entry into the market.

Shelf Companies: Quick Setup with Established History

A Shelf Company is a pre-registered entity that has been legally formed but remains dormant, meaning it has no ongoing operations or liabilities. Here’s why it might be a good choice for you:

New Legal Entity Formation: Customizable but Time-Consuming

Starting a new legal entity from scratch allows you to customize your company structure from the ground up. While the process takes longer, there are several benefits:

Compliance: The process ensures that all aspects of your new entity align with the latest regulatory and legal requirements in Ireland.

Company formation overseas involves the process of incorporation, where a business entity is formally created and registered with the relevant authorities. This process establishes the legal existence of the company, allowing it to conduct business activities in the country.

Forming a private limited company in Ireland requires specific documentation and fulfilling certain statutory requirements. These may include the memorandum and articles of association, details of company directors and shareholders, and the registered office address.

"Working with House of Companies was simple. They handled everything with the local notary, saving me valuable time and effort."

Logistics Company Owner

Logistics Company Owner"As an online retailer, I needed a local presence in Ireland . The branch registration process was easy and stress-free."

E-commerce Business Owner

E-commerce Business Owner"Our staffing needs meant we had to register in France. Entity Management made it straightforward and seamless."

Recruitment & Payroll Specialist

Recruitment & Payroll SpecialistIf a branch registration for your existing company doesn’t meet your needs, explore our blog and roadmaps for country-specific pros and cons. When you’re ready to incorporate locally, House of Companies is here to provide full support.

Learn More →

Learn More →

Learn More →

Choosing a company name goes beyond branding—it's a formal identifier of the business that needs to be unique. To prevent issues, the chosen name should not conflict with trademarks or registered names already listed in the Irish Companies Registration Office (CRO). This helps avoid legal disputes or confusion with other businesses.

When forming a company in Ireland, it's crucial to decide on the capital amount and distribution of shares among stakeholders. These details need to be recorded in official documents, as they determine ownership stakes, voting rights, and financial responsibilities within the company.

The Articles of Association are foundational documents that define a company's internal rules and structure. They outline how decisions are made, shareholder rights, and procedures for handling different operational situations. This document essentially governs how the company will function internally.

Irish company law outlines various requirements for incorporating a business, including regulations on structure, governance, and reporting. Compliance ensures that the company operates legally and avoids penalties. It also involves fulfilling statutory duties such as record-keeping and financial reporting.

Although not always mandatory, a company secretary in Ireland can be instrumental in maintaining compliance with legal requirements. They manage essential records, facilitate regulatory communications, and ensure the company meets its legal obligations—critical for avoiding regulatory issues.

Some industries in Ireland have unique regulations, covering areas like taxation, operational procedures, and licensing. Understanding these requirements is crucial to ensure that the business operates within legal boundaries and avoids unnecessary complications.

Professional services (like those offered by legal or business consulting firms) can handle the extensive paperwork and filing requirements involved in Irish company formation. This helps ensure the documentation is complete, accurate, and compliant, simplifying the setup process for the business owner.

Starting a company overseas can be complex, and hiring local legal, tax, and entity management experts can make the process smoother. Professionals can help you navigate the local business environment and avoid costly mistakes.

Irish law requires companies to have a registered office—a physical address for official correspondence. A local agent may also be necessary, especially for international companies, to manage administrative tasks and ensure compliance with local regulations.

Professional advisors provide tailored guidance on structuring the company in a way that optimizes tax and operational efficiency, while ensuring full compliance with Irish laws. This is especially helpful for foreign companies unfamiliar with Irish corporate regulations.

Expanding internationally has traditionally required navigating cultural differences, legal frameworks, and regulatory requirements. By drawing on extensive experience, firms like House of Companies help businesses overcome these challenges and ease the entry process into the Irish market.

The cost of company formation in Ireland can vary depending on the type of business and specific requirements. House of Companies offers competitive pricing for essentials like documentation and initial capital requirements, ensuring that your setup costs are manageable.

Professionals, such as accountants and lawyers, play a key role in managing the complex requirements of company formation. They ensure the business complies with regulatory and financial obligations, reducing the risk of errors and helping your company get off to a strong start.

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

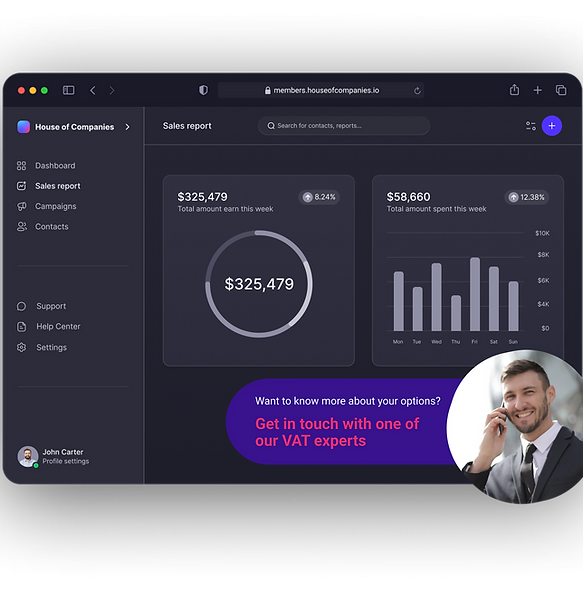

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!