Blockchain technology, with its promise of transparency and decentralized ledger systems, revolutionizes more than just financial transactions; it redefines legal business structures.

Smart Company registration on blockchain marks a new era for legal entities, harnessing the trust, security, and efficiency rooted in this technology. Facing a transformative shift, entrepreneurs can now envisage integrating tangible and intangible assets within immutable blocks of data, paving the way for global business innovation that aligns with House of Companies' vision of simplifying and empowering the international entrepreneurial journey.

In the vanguard of entrepreneurial innovation, SMART Companies on Blockchain are redefining the essence of trust, security, and transparency in business. These entities leverage blockchain's shared and immutable ledger, fortifying trust through end-to-end encryption and fostering transparency with identical records distributed across multiple locations. The decentralized architecture of blockchain companies ensures an egalitarian network, devoid of superiority or bias, while immutable records slash costs and bolster security.

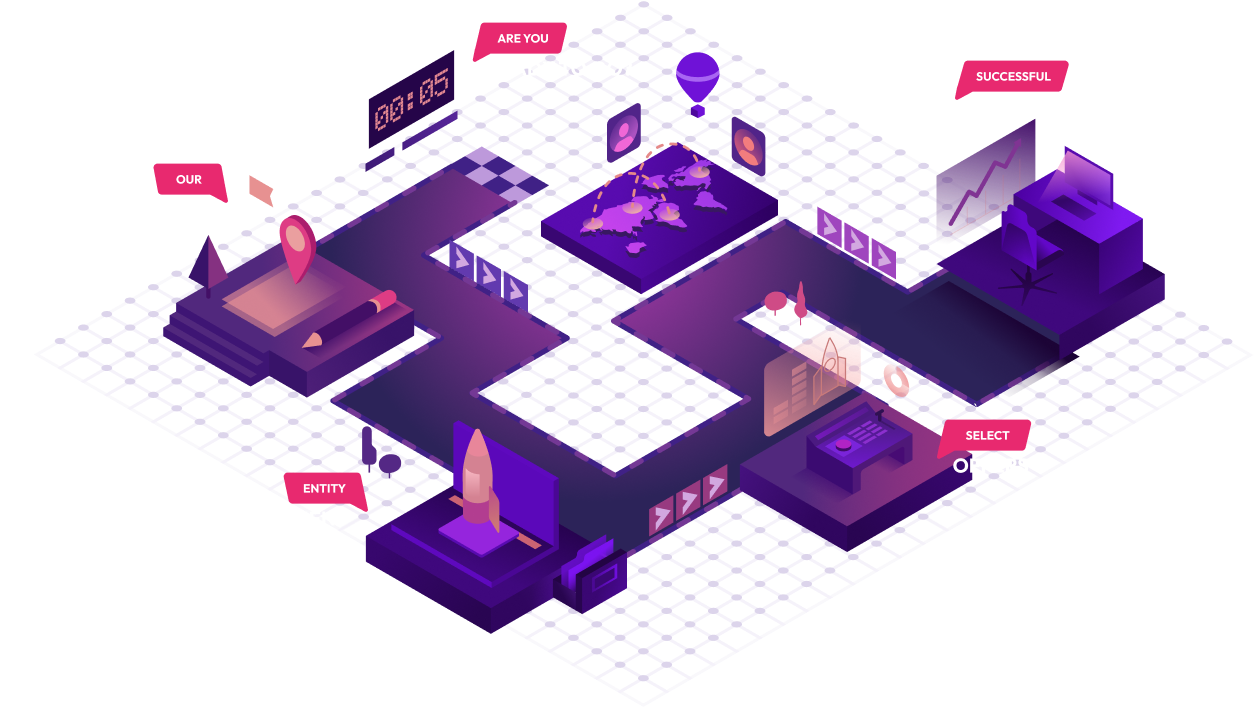

Smart Company registration on blockchain technology is a savvy move for the modern entrepreneur. The process is quite straightforward, and with a sprinkle of innovation by House of Companies, it's available for any type of entrepreneur, even if you are still unfamiliar with blockchain or smart contracts. Here's how to get started:

By following these steps, you'll have your Smart Company up and running on the blockchain in no time. In fact, companies like Proxeus and IBM Switzerland have demonstrated that this process can be completed in less than two hours, a testament to the efficiency of blockchain technology. Remember, it's not just about starting a business on blockchain technology; it's about pioneering a new era of corporate existence.

Entrepreneurs eyeing Smart Company registration should consider the global landscape, where jurisdictions are not created equal. The following locales stand out for their crypto-friendly climates and strategic advantages:

Estonia: A pioneer in digital governance, Estonia's regulatory framework for cryptocurrencies is well-established, with a clear taxation policy that doesn't apply VAT to Bitcoin and altcoins. The process for SMART company registration is efficient, with English and Russian as official languages for interaction with regulators. However, patience is required as the license application consideration can extend up to six months, accompanied by a state fee of 3,300 euros.

Singapore: Known for its robust economy and business-friendly environment, Singapore treats cryptocurrency as a commodity, with settlements seen as barter trade. Crypto companies must navigate a 7% goods and services tax but benefit from a supportive regulatory approach, requiring a license from the

Monetary Authority of Singapore (MAS).

Switzerland: The Crypto Valley offers a fintech license and AML compliance for legal cryptocurrency operations. Switzerland also provides a "sandbox" for businesses to test products and models without a license. Profits from digital asset operations are taxed according to Swiss law, maintaining the country's reputation for financial innovation.

Canada: With a registration valid for two years, Canada mandates crypto companies to register with FINTRAC as an MSB, ensuring compliance with financial regulations. Sellers of cryptocurrencies must report income on tax returns, reflecting Canada's structured approach to crypto businesses.

Malta: Despite a slow license issuance, Malta's tax regime is attractive, with an income tax of only 5%. The country offers various classes of crypto business licenses, albeit at a higher cost, positioning itself as a hub for blockchain enterprises.

British Virgin Islands and

Seychelles: Both jurisdictions provide strong infrastructure, a developed legal system, and high privacy levels for company owners, with no income or capital gains taxes on crypto enterprises. These offshore havens are ideal for those seeking confidentiality and tax advantages.

Saint Vincent and Grenadines: SVG supports blockchain technology without imposing taxes, offering a confidential environment for businesses.

Each jurisdiction has its unique blend of regulatory frameworks, tax policies, and support for blockchain technology, making them attractive destinations for Smart Company Formation.

Entrepreneurs should weigh these factors alongside their business needs to start a company on Ethereum or other blockchain platforms, ensuring a strategic and compliant entry into the crypto space.

Looking to establish a blockchain-based business in Ireland? As a thriving hub for tech innovation and financial services, Ireland offers a supportive ecosystem for blockchain enterprises. By understanding the regulatory framework and utilizing modern tools, such as blockchain technology, you can position your business for success.

To register a branch office of an offshore SMART company (e.g., those based in jurisdictions like Delaware or the Seychelles) in Ireland, the following documents are typically required:

It’s essential to note that a branch office is not a separate legal entity and operates under the same legal identity as its parent company. If the branch is considered a permanent establishment (PE), it will be subject to Ireland's corporate tax (12.5%) and VAT regulations. For non-PE branches, tax obligations may differ, often focusing on withholding taxes or limited local levies.

Ireland is emerging as a leading destination for blockchain companies, supported by its:

Ireland also provides attractive tax incentives for research and development (R&D), which can be leveraged by blockchain startups to optimize their costs.

Yes, Ireland supports blockchain technology within a regulated framework. Businesses must comply with data protection laws (GDPR) and financial regulations where applicable.

Ireland’s corporate tax rate is 12.5%, with additional incentives like R&D tax credits and favorable treatment for intellectual property and digital assets.

The process includes selecting a blockchain platform, securing regulatory approvals, deploying smart contracts, and registering your business through Ireland’s Companies Registration Office (CRO).

You’ll need incorporation documents, financial statements, a board resolution, and more to comply with Irish laws.

Blockchain technology is not just a buzzword; it's a revolutionary force in the corporate world. SMART Companies, or blockchain-based legal entities, offer a suite of advantages over traditional corporations, making the concept of Smart Company registration not just innovative but also incredibly savvy for the forward-thinking entrepreneur. Let's unpack these advantages:

These advantages clearly depict why entrepreneurs are gravitating towards the idea of how to start your smart company and why jurisdictions like the Seychelles Smart Company and Hong Kong Smart Company are becoming hotspots for Smart Company Formation. It's not just about the ability to start a business on blockchain technology; it's about redefining what it means to be a company in the digital age.

"Dealing with local notary requirements was a hassle. I registered my UK LTD in Ireland with the help of Entity Management."

Maria SEntrepreneur

Maria SEntrepreneur"I didn’t really want to start a local business…so confusing. But I needed a local company number. The branch works great!"

Maria SEntrepreneur

Maria SEntrepreneur"The outsourcing of staff required us to register in Germany. Entity Management is a perfect fit for us!"

Maria SEntrepreneur

Maria SEntrepreneurThe registration of a Smart Company might not be the best option for you. In our Blogs, and Roadmaps, we explain the Pro’s and Con’s in more detail for each country.

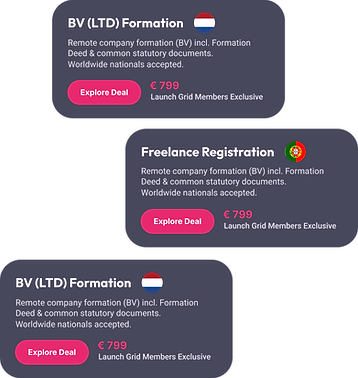

If you decide to incorporate a local company, House of Companies can assist you with the incorporation.

Learn More →

Learn More →

Learn More →

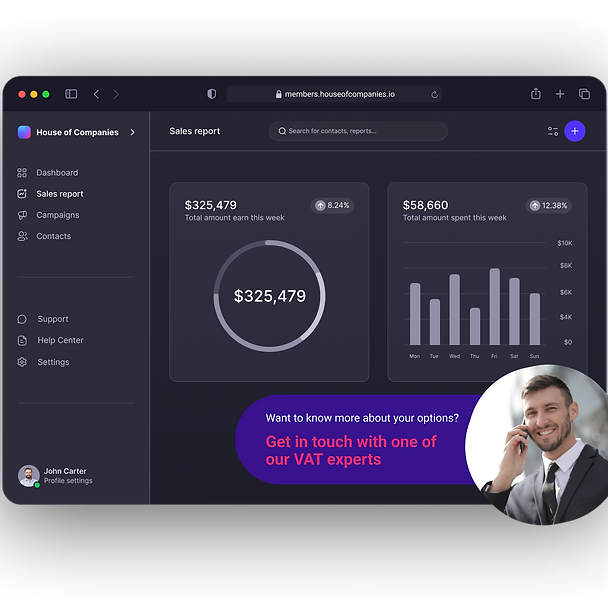

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!