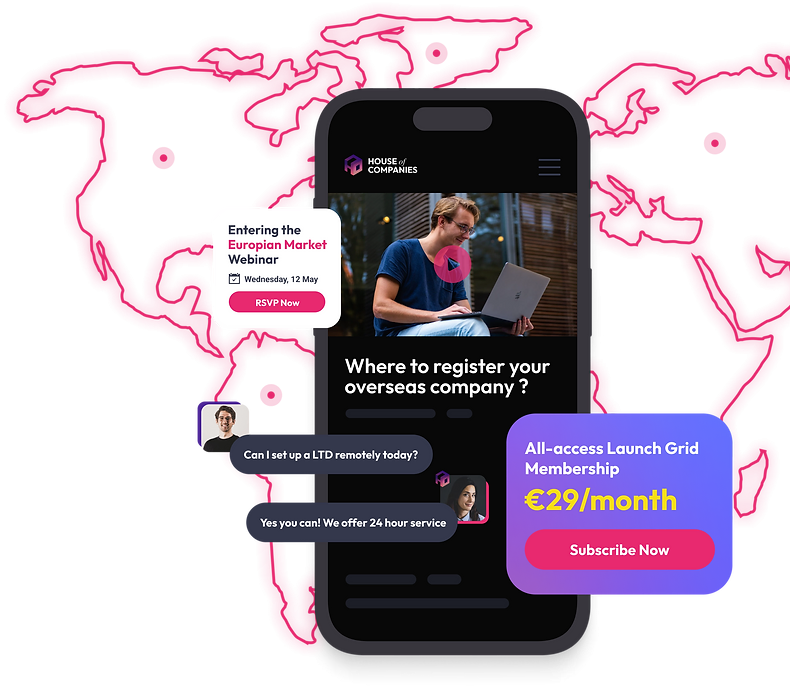

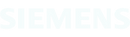

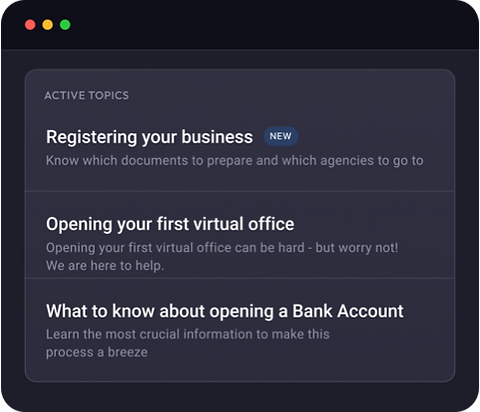

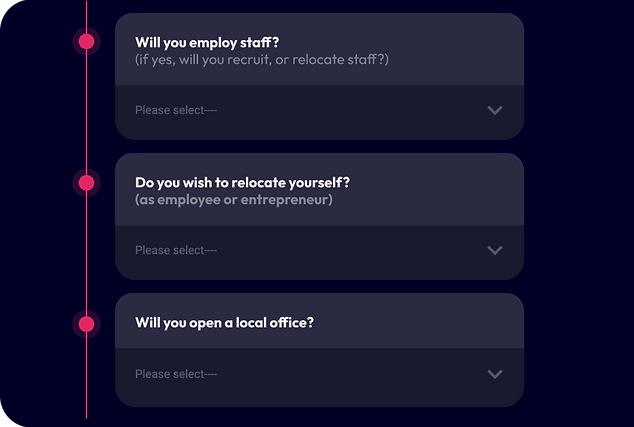

Managing a small or medium-sized enterprise (SME) in Ireland can be challenging, but House of Companies offers a streamlined solution for entity management. Our innovative platform empowers entrepreneurs to handle their company's compliance and administrative tasks efficiently, without the need for an accountant. With features like a real-time dashboard, automated tax compliance calendar, and personalized guidance from our team, you can ensure your business stays compliant and operates smoothly.

"The Most Effective Strategy to Expand Your Business in Ireland

Without Attorneys and Accountants"

House of Companies in Ireland provides expert support to keep your business compliant and efficient, handling entity management, tax compliance, and more, so you can focus on growth.

Learn More →

Learn More →

Learn More →

Non-residents looking to establish a business presence in Ireland can enjoy numerous benefits with House of Companies. Our platform simplifies the process of setting up and managing an entity remotely, providing access to a real-time dashboard and automated compliance tools. Non-residents can take advantage of Ireland's favorable tax regime, including low corporate tax rates and various incentives for foreign investors.

“I needed a VAT ID in Ireland without forming a local company. The platform allowed me to handle all returns without the involvement of an accountant.”

Lisa MIT Consultant

Lisa MIT Consultant“The support from Entity Management outperformed local banks. Direct communication and expert guidance made handling my financial needs a breeze.”

Julia RFood Exporter, Tunisia

Julia RFood Exporter, Tunisia“As an entrepreneur from India, I expected limited transactions in the EU market but still needed a reliable local bank account. Entity Management provided a quick, cost-efficient solution.”

Anna LGlobal IT Recruitment Specialist

Anna LGlobal IT Recruitment Specialist“I secured my VAT ID application without establishing a local entity. The Entity Management service simplified everything.”

Rebecca SRetail Entrepreneur

Rebecca SRetail Entrepreneur“I required a VAT ID for my online business, and the results were flawless.”

Tom HOnline Marketplace Seller

Tom HOnline Marketplace Seller

For early adopters that fill out our Countdown Form only.

Let's discuss your choices.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!