House of Companies Help You Get Started! Our tailored consulting services and cutting-edge Entity Portal empower you to effortlessly register and manage your business in Ireland, all without the need for a lawyer or accountant. Enjoy complete control over your business setup and operations, backed by expert guidance every step of the way.

In Ireland, a Limited Company (LTD) is a fundamental business structure governed by the Companies Act 2014. This legal framework provides protection, flexibility, and operational efficiency, making LTDs attractive in the Irish business ecosystem.

LTDs possess a separate legal personality, distinguishing company assets and liabilities from shareholders'. This separation enables limited liability, protecting shareholders' personal assets. The structure allows for a single member and director, ideal for sole entrepreneurs. LTDs also benefit from Ireland's competitive 12.5% corporate tax rate on trading income.

The Companies Act 2014 has streamlined LTD formation and management by simplifying documentation requirements and reducing administrative burdens. LTDs now operate with a single-document constitution, replacing the previous memorandum and articles of association.

For detailed guidance on establishing and managing an LTD, visit the Companies Registration Office (CRO) website.

A Private Limited Company (LTD) in Ireland is a distinct legal entity under the Companies Act 2014. This structure combines flexibility and protection, allowing 1-149 shareholders and requiring just one director. The LTD's constitution, a single document outlining internal regulations, replaces traditional memorandum and articles of association.

An important aspect of LTDs is their restriction on public share offerings. Unlike Public Limited Companies (PLCs), LTDs cannot offer shares or debentures to the public. This limitation helps maintain control over company ownership and direction. LTDs also face fewer regulatory requirements compared to PLCs, particularly in financial reporting and annual general meetings.

The legal framework provides operational flexibility, with many LTDs eligible for audit exemptions under certain conditions, reducing compliance costs. The absence of a required objects clause allows LTDs to engage in any legal business activity without constitutional amendments.

The LTD structure offers significant advantages for businesses in Ireland. Its primary benefit is limited liability protection, safeguarding shareholders' personal assets from company debts. This structure provides flexibility in ownership and management, allowing operation with just one director and shareholder.

From a financial perspective, Ireland's competitive 12.5% corporate tax rate on trading income makes LTDs attractive. Companies can access various tax incentives, including the Research and Development Tax Credit scheme. Additionally, the LTD structure enhances business credibility, potentially improving relationships with customers, suppliers, and investors, particularly beneficial for expansion and international trade.

For entrepreneurs considering the LTD structure, the Enterprise Ireland website offers key resources for business setup and growth.

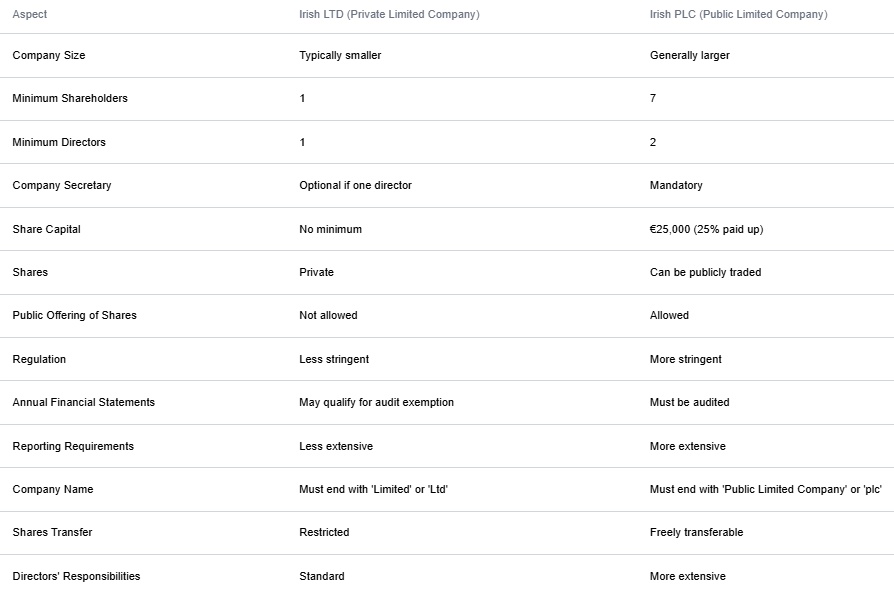

Understanding the distinctions between Private Limited Companies (LTD) and Public Limited Companies (PLC) in Ireland is essential for making informed business structure decisions.

While LTDs are limited to 149 shareholders, PLCs can offer shares publicly and list on stock exchanges. Capital requirements also differ significantly - LTDs have no minimum requirement, while PLCs must maintain €25,000 minimum share capital, with 25% paid up.

Governance structures vary too. LTDs can operate with one director, while PLCs require at least two. PLCs must hold physical Annual General Meetings (AGMs), whereas LTDs can often use written resolutions instead.

LTDs may qualify for audit exemptions, reducing costs, while PLCs face stricter financial reporting requirements and mandatory annual audits.

Naming conventions distinguish these entities - LTDs use "Limited" or "Ltd" (or Irish equivalents), while PLCs must use "Public Limited Company" or "PLC".

A Flex LTD, officially known as a Designated Activity Company (DAC) in Ireland, is a hybrid corporate structure introduced under the Companies Act 2014, combining elements of private and public limited companies.

The defining characteristic of a DAC is its objects clause, which must specify the company's authorized activities, unlike standard LTDs that can conduct any legal business. While this may seem limiting, it provides operational clarity and meets specific regulatory requirements.

A key advantage of DACs is their ability to issue debentures to the public, making them attractive for financial activities and specialized funding structures. This feature offers additional capital-raising options without the full regulatory requirements of public limited companies.

Governance-wise, DACs can operate with a single director but must maintain a separate company secretary, ensuring appropriate corporate oversight.

DACs are particularly suited for joint ventures, special purpose vehicles, and regulated entities, especially in financial services. The structure provides necessary specificity while retaining limited liability benefits.

Following the Companies Act 2014, many existing companies converted to DACs, preferring its similarity to the old private limited company format. For more information on DACs and company comparisons, visit the Companies Registration Office - DAC page.

The process of incorporating a Limited Company (LTD) in Ireland is governed by the Companies Act 2014, which streamlined and modernized the incorporation procedure. This comprehensive process ensures that your company is legally recognized and compliant with Irish law from its inception. The incorporation journey begins with choosing a unique company name and concludes with receiving your certificate of incorporation from the Companies Registration Office (CRO).

To start, you must select a company name that is not already in use and complies with the naming regulations set forth by the CRO. Once you have a suitable name, you’ll need to prepare the necessary documentation. This includes the Form A1, which is the primary application for incorporation, and the company’s constitution. The constitution is a single document that outlines the company’s internal regulations and replaces the old memorandum and articles of association.

After preparing these documents, you’ll submit them to the CRO along with the required registration fee. The CRO will then review your application to ensure it meets all legal requirements. Upon approval, you’ll receive a certificate of incorporation, officially establishing your LTD as a legal entity in Ireland.

The timeline for starting an LTD in Ireland can vary depending on several factors, but generally, the process is relatively swift compared to many other jurisdictions. From the moment you submit a complete and accurate application to the Companies Registration Office (CRO), the standard processing time is typically between 5 to 10 working days.

However, it’s important to note that this timeframe assumes that all documentation is correctly prepared and submitted without any errors or omissions. Any discrepancies or incomplete information can lead to delays in the process. The CRO may request additional information or clarification, which can extend the incorporation timeline.

To expedite the process, ensure that all required forms are filled out accurately and completely. Pay particular attention to the Form A1 and the company constitution, as these are the primary documents scrutinized by the CRO. Additionally, make sure that your chosen company name is available and complies with naming regulations to avoid potential setbacks.

For those requiring faster processing, the CRO offers a fee-based express service that can significantly reduce the waiting time. This service is particularly useful for businesses with urgent incorporation needs.

Registering your new LTD with the Irish Companies Registration Office (CRO) is a crucial step in the incorporation process. This registration officially recognizes your company as a legal entity in Ireland and is mandatory under the Companies Act 2014.

To register, you must submit Form A1 to the CRO. This comprehensive form requires detailed information about your company, including the proposed company name, registered office address, details of directors and secretary, share capital information, and details of the company subscribers (initial shareholders).

Along with Form A1, you must also submit your company’s constitution. This single document outlines the internal regulations of your company and must comply with the requirements set out in the Companies Act 2014.

Once these documents are prepared, you can submit them to the CRO either online through their CORE system or by post. Online submission is generally faster and is the preferred method for most incorporations.

Upon receipt, the CRO will review your application to ensure all information is complete and complies with legal requirements. If everything is in order, they will process your application and issue a certificate of incorporation. This certificate is your company’s birth certificate, proving its legal existence and limited liability status.

For detailed instructions on how to register your LTD and access to the necessary forms, visit the CRO’s company registration page.

Starting an Irish LTD requires gathering and preparing specific information to ensure a smooth incorporation process. The Companies Registration Office (CRO) requires comprehensive details about your proposed company to process your application.

Firstly, you need to decide on a unique company name that complies with CRO regulations. This name should not be identical or too similar to an existing company name and must not contain any restricted words or phrases.

You must provide the company’s registered office address, which must be a physical location in Ireland. This address will be used for official communications and must be capable of receiving legal notices.

Details of the company directors and secretary are crucial. For an LTD, you need at least one director (who must be at least 18 years old) and a company secretary (which can be the same person as the director if there’s only one). You’ll need to provide their full names, residential addresses, dates of birth, occupations, and nationalities.

Information about the company’s share capital is also required. This includes the total authorized share capital, the number and class of shares to be issued, and the nominal value of each share.

You must also provide details of the company subscribers (initial shareholders), including their names, addresses, and the number and class of shares they will hold.

Lastly, you need to prepare the company’s constitution, which outlines the internal regulations of the company. This document replaces the old memorandum and articles of association and must comply with the Companies Act 2014.

While selecting a notary is not a mandatory step in the process of incorporating an LTD in Ireland, it can be beneficial in certain circumstances, particularly for foreign investors or those incorporating from outside Ireland.

A notary public in Ireland is a qualified lawyer appointed by the Chief Justice of Ireland to authenticate documents, witness signatures, and provide certified copies of important documents. In the context of company incorporation, a notary can be helpful in verifying the authenticity of documents that need to be submitted to the Companies Registration Office (CRO).

For instance, if you’re incorporating from abroad, you might need to have certain documents notarized in your home country before they can be accepted by the CRO. This could include proof of identity for directors or shareholders, or power of attorney documents.

Additionally, a notary can be useful in certifying copies of original documents, which can be particularly important if you need to submit documents to multiple agencies or keep original documents for other purposes.

While the CRO doesn’t typically require notarized documents for standard incorporations, having a notary involved can add an extra layer of legal certainty to your incorporation process. This can be especially valuable if you anticipate any complexities in your incorporation or if you’re dealing with international stakeholders.

Reserving a company name is an optional but often advisable step in the process of incorporating an LTD in Ireland. It allows you to secure your chosen name while you prepare the rest of your incorporation documents, ensuring that no other company can register with the same name in the meantime.

To reserve a company name, you need to submit a Form RBN1 to the Companies Registration Office (CRO). This form allows you to reserve a name for a period of 28 days, which can be extended for an additional 28 days if needed.

Before submitting the form, it’s crucial to check if your desired name is available. The CRO provides an online search facility where you can check existing company names. Your chosen name must be unique and not too similar to existing company names to avoid confusion.

There are also certain restrictions on company names. For example, the name cannot suggest a connection with the Irish government or state authorities unless you have permission. It also can’t contain words that might be considered offensive or contradict public policy.

Remember that reserving a name doesn’t guarantee that it will be accepted for incorporation. The CRO still reviews the name during the incorporation process to ensure it fully complies with all regulations.

Under the Companies Act 2014, the traditional memorandum and articles of association have been replaced by a single document called the constitution for LTDs in Ireland. This change was part of the Act’s aim to simplify company law and reduce administrative burdens on businesses.

The constitution is a crucial document that sets out the fundamental rules governing your company’s operations. It includes information such as the company’s name, the fact that it’s a private company limited by shares, and details about the share capital.

Key elements that must be included in the constitution are:

The company’s name

A statement that it’s a private company limited by shares

The amount of share capital and initial shareholdings

A statement that the liability of members is limited

Details of the rights attaching to shares

The constitution also typically includes provisions about the appointment and removal of directors, procedures for general meetings, and any restrictions on the transfer of shares.

Establishing a Limited Company (LTD) in Ireland offers a gateway to the European market and benefits from Ireland’s favorable business environment. The process, governed by the Companies Act 2014, is designed to be straightforward for both local and international entrepreneurs. Key steps include selecting a unique company name, determining the company structure, appointing directors and a company secretary, establishing a registered office, registering with the Companies Registration Office (CRO), and obtaining a company number.

Ireland’s pro-business policies, competitive tax rates, and access to EU markets make it an attractive location for global entrepreneurs. The country’s regulatory framework ensures transparency and compliance while offering flexibility in company operations. By following these steps and understanding the legal requirements, entrepreneurs can efficiently set up their LTD and begin operations in this dynamic business environment.

For comprehensive guidance on each step of the process, visit the Companies Registration Office website. This official resource provides up-to-date information on legal requirements, forms, and procedures necessary for company formation in Ireland.

Selecting an appropriate company name is a crucial first step in establishing an LTD in Ireland. The chosen name must be unique and distinguishable from existing registered companies to avoid confusion and potential legal issues. The Companies Registration Office (CRO) provides an online search facility to check the availability of your desired name.

When choosing a name, consider the following guidelines:

The name must end with “Limited” or “Ltd” (or their Irish equivalents “Teoranta” or “Teo”).

It should not be identical or too similar to an existing company name.

Avoid names that suggest a connection with the Irish government or state authorities without permission.

Refrain from using words that may be considered offensive or contradict public policy.

Once you’ve selected a suitable name, you can reserve it by submitting Form RBN1 to the CRO. This reservation holds the name for 28 days, extendable for another 28 days if needed, giving you time to complete the incorporation process.

Determining the company structure is a critical decision when setting up an LTD in Ireland. The structure defines the internal organization, including the roles and responsibilities of directors, shareholders, and the company secretary. Under Irish law, an LTD can have between one and 149 shareholders, offering flexibility for various business sizes and types.

Key considerations for your company structure include:

Number of Directors: An LTD must have at least one director, but can have more for enhanced governance.

Shareholding Structure: Decide on the number of shares and their distribution among shareholders.

Decision-making Processes: Establish how major decisions will be made and documented.

Company Constitution: Draft a constitution that outlines the company’s internal regulations, replacing the traditional memorandum and articles of association.

The company’s constitution is a crucial document that must comply with the Companies Act 2014. It should reflect your business’s specific needs and operational procedures, including provisions for share transfers, director appointments, and general meetings.

For guidance on company structures and constitution requirements, refer to the CRO’s company registration guide.

Appointing directors and a company secretary is a mandatory requirement for LTDs in Ireland. These roles are crucial for the company’s governance and compliance with legal obligations.

Directors:

At least one director is required, who must be at least 18 years old.

Directors are responsible for the company’s management and strategic direction.

They must act in the company’s best interests and comply with their duties under the Companies Act 2014.

At least one director must be a resident of the European Economic Area (EEA), or the company must post a bond.

Company Secretary:

Every LTD must have a company secretary, who can be one of the directors if there’s more than one.

The secretary ensures the company complies with statutory obligations, maintains company records, and files annual returns.

If there’s only one director, the company secretary must be a different person.

Both directors and the company secretary must provide their consent to act in these roles. Their details, including full name, date of birth, and residential address, must be submitted to the CRO as part of the incorporation process.

For more information on the roles and responsibilities of directors and company secretaries, visit the CRO’s director and secretary guidelines.

Establishing a registered office address is a legal requirement for all LTDs in Ireland. This address serves as the official point of contact for the company and must be a physical location within Ireland where legal documents can be served and official communications received.

Key points about the registered office address:

It must be a physical address in Ireland, not just a P.O. Box.

The address will be publicly available on the company register.

It should be capable of receiving correspondence during normal business hours.

Many companies use their accountant’s or solicitor’s address for privacy reasons.

The address must be included in the company’s constitution and on all official company documents.

Changes to the registered office address must be notified to the CRO within 14 days using Form B2. It’s crucial to maintain an up-to-date registered office address to ensure receipt of important legal and regulatory communications.

For businesses without a physical presence in Ireland, various service providers offer registered office address services, ensuring compliance with this legal requirement.

Registering your LTD with the Companies Registration Office (CRO) is a crucial step in the incorporation process. This registration officially establishes your company as a legal entity in Ireland.

The registration process involves:

Preparing and submitting Form A1, which includes:

Company name and registered office address

Details of directors and company secretary

Share capital information

Subscriber details

Submitting the company’s constitution

Paying the registration fee

You can submit these documents online through the CRO’s CORE system or by post. Online submission is generally faster and is the preferred method for most incorporations.

Upon receipt, the CRO will review your application to ensure all information is complete and complies with the Companies Act 2014. If everything is in order, they will process your application and issue a certificate of incorporation.

The final step in setting up your LTD in Ireland is obtaining a company number. This unique identifier is assigned by the Companies Registration Office (CRO) upon successful incorporation of your company.

Key points about the company number:

It’s a unique six or seven-digit number assigned to your company.

The number is included on your certificate of incorporation.

It must be displayed on all company letterheads, order forms, and websites.

The number is used in all communications with the CRO and other government agencies.

It’s required for opening a business bank account and registering for taxes with the Revenue Commissioners.

The company number serves as your company’s official identifier throughout its lifetime. It’s used to file annual returns, submit changes to company details, and in any official correspondence related to your company.

Opening a business bank account is a crucial step in establishing your Limited Company (LTD) in Ireland. This process not only separates your personal and business finances but also enhances your company’s credibility and simplifies financial management. To open a business account, you’ll typically need to provide the bank with your company’s Certificate of Incorporation, Constitution, and proof of identity and address for all directors and significant shareholders.

Irish banks often require a face-to-face meeting to open a business account, even if you’re a non-resident director. During this meeting, you may need to present a business plan and financial projections. Some banks also offer online account opening processes, which can be more convenient for international entrepreneurs.

It’s advisable to compare different banks’ offerings, as fees, services, and requirements can vary. Some popular banks for business accounts in Ireland include Bank of Ireland, AIB, and Ulster Bank. Each has its own set of advantages, so research thoroughly to find the best fit for your business needs.

For more information on banking regulations and consumer protection in Ireland, visit the Central Bank of Ireland’s website.

The Costs of Setting Up an LTD: What You Need to Know

Understanding the costs involved in setting up an LTD in Ireland is essential for proper financial planning. The expenses can be broadly categorized into initial setup costs and ongoing operational costs.

Initial setup costs typically include:

Ongoing costs to consider include:

It’s important to budget for these costs and factor them into your business plan. While the initial setup costs are relatively low, the ongoing compliance and operational costs can be significant depending on your business size and activities.

For a detailed breakdown of CRO fees, visit the CRO’s fees page.

One of the advantages of setting up an LTD in Ireland is the flexibility in share capital requirements. Unlike some other jurisdictions, Ireland does not impose a minimum share capital for private limited companies. This makes it accessible for entrepreneurs with varying levels of initial investment.

While there’s no legal minimum, it’s common practice to issue a nominal amount of share capital, often starting with €100 divided into 100 shares of €1 each. This approach provides a simple structure that can be easily adjusted as the company grows.

Key points to consider about share capital:

The number and value of shares must be stated in the company’s constitution.

Shares can be issued as fully paid, partly paid, or nil paid.

Different classes of shares with varying rights can be created.

The company can increase its share capital later through the issuance of new shares.

It’s important to note that while a low initial share capital can make setup easier, it may impact the company’s ability to secure loans or attract investors in the future. Therefore, it’s advisable to consider your long-term business plans when deciding on the initial share capital.

Issuing new shares for your Irish LTD can be an effective way to raise capital for business growth or bring in new investors. The process is governed by the Companies Act 2014 and your company’s constitution.

Steps to issue new shares:

Check your company’s constitution for any restrictions on issuing shares.

Hold a board meeting to approve the share issuance.

If required by your constitution, obtain shareholder approval.

Prepare and file a Form B5 with the Companies Registration Office (CRO) within 30 days of the share allotment.

Update the company’s register of members.

Issue share certificates to the new shareholders.

Key considerations:

Pre-emption Rights: Existing shareholders may have the right to first refusal on new shares.

Share Classes: Decide whether the new shares will be of the same class as existing shares or a new class with different rights.

Valuation: Determine the price at which new shares will be issued, especially important for tax purposes.

It’s crucial to maintain accurate records of all share transactions and to file the necessary documents with the CRO in a timely manner. Failure to do so can result in penalties and legal complications.

For detailed guidance on share issuance and related forms, visit the CRO’s share allotment page.

Understanding and complying with the Irish tax system is crucial for the successful operation of your LTD. The main taxes that apply to limited companies in Ireland include:

Corporation Tax: The standard rate is 12.5% on trading income, one of the lowest in Europe. A higher rate of 25% applies to non-trading income.

Value Added Tax (VAT): If your company’s turnover exceeds €75,000 for goods or €37,500 for services, you must register for VAT.

Pay As You Earn (PAYE): This system is used to collect income tax from employees’ wages.

Pay Related Social Insurance (PRSI): Both employers and employees contribute to this social welfare fund.

Capital Gains Tax: Applied to profits from the sale of assets, currently at 33% for companies.

Dividend Withholding Tax: A 25% withholding tax applies to dividends paid to shareholders, with some exemptions.

It’s important to register for taxes promptly after incorporation. This can be done through the Revenue Commissioners’ online service, ROS (Revenue Online Service).

For comprehensive information on Irish corporate taxes, visit the Revenue Commissioners’ website.

Maintaining compliance with Irish company law is essential for the continued operation of your LTD. Key compliance and reporting requirements include:

Annual Return: Must be filed with the Companies Registration Office (CRO) each year, accompanied by financial statements.

Financial Statements: These must be prepared in accordance with Irish GAAP or IFRS and filed with the CRO, unless the company qualifies for audit exemption.

Corporation Tax Return: To be filed annually with the Revenue Commissioners, typically within 9 months of the company’s financial year-end.

VAT Returns: If registered for VAT, returns must be filed regularly (usually bi-monthly).

Payroll Taxes: PAYE and PRSI must be reported and paid monthly.

Maintaining Statutory Registers: Including registers of members, directors, and secretaries.

Notifying the CRO of any changes in company details, such as registered office, directors, or share capital.

Failure to comply with these requirements can result in penalties, loss of audit exemption status, or even the striking off of the company from the register.

For more details on compliance requirements, visit the CRO’s compliance page.

While Ireland doesn’t have a general business license requirement for LTDs, certain industries and activities may require specific licenses or permits. It’s crucial to check if your business activities fall under any regulated sectors.

Common areas requiring licenses include:

Financial Services: Regulated by the Central Bank of Ireland.

Food and Beverage: Requires health and safety certifications.

Pharmaceuticals and Healthcare: Regulated by the Health Products Regulatory Authority.

Construction and Engineering: May require specific qualifications and registrations.

Environmental Activities: Permits may be needed from the Environmental Protection Agency.

To determine if your business requires any specific licenses:

Check with your local authority (county or city council).

Consult the relevant regulatory body for your industry.

Visit the Citizens Information website for general guidance on business regulations.

Remember, operating without the necessary licenses can lead to legal issues and penalties, so it’s important to research and obtain all required permits before commencing operations.

Appointing directors is a crucial step in establishing and running your LTD in Ireland. Directors are responsible for managing the company’s affairs and ensuring compliance with legal obligations.

Key points about appointing directors:

Minimum Requirement: An Irish LTD must have at least one director.

EEA Resident Director: At least one director must be resident in the European Economic Area (EEA), or the company must post a bond.

Age Requirement: Directors must be at least 18 years old.

Restrictions: Certain individuals, such as undischarged bankrupts or those disqualified by court order, cannot serve as directors.

The appointment process involves:

Obtaining the individual’s consent to act as a director.

Providing their personal details to the CRO using Form B10.

Updating the company’s register of directors.

Directors have significant legal responsibilities, including:

Acting in the company’s best interests

Complying with company law and the company’s constitution

Maintaining proper books of account

Preparing and filing annual returns and financial statements

It’s advisable for new directors to familiarize themselves with their legal duties and responsibilities. The Office of the Director of Corporate Enforcement provides useful guidance on directors’ duties.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!