At House of Companies, we are committed to providing our clients in Ireland with the most comprehensive and advanced bookkeeping services. Our team of experts uses state-of-the-art tools and technologies to deliver solutions that are specifically tailored to meet your business needs. With our expert support, you can rest assured that your bookkeeping is in the best hands. Let's get started today!

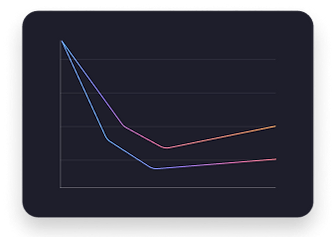

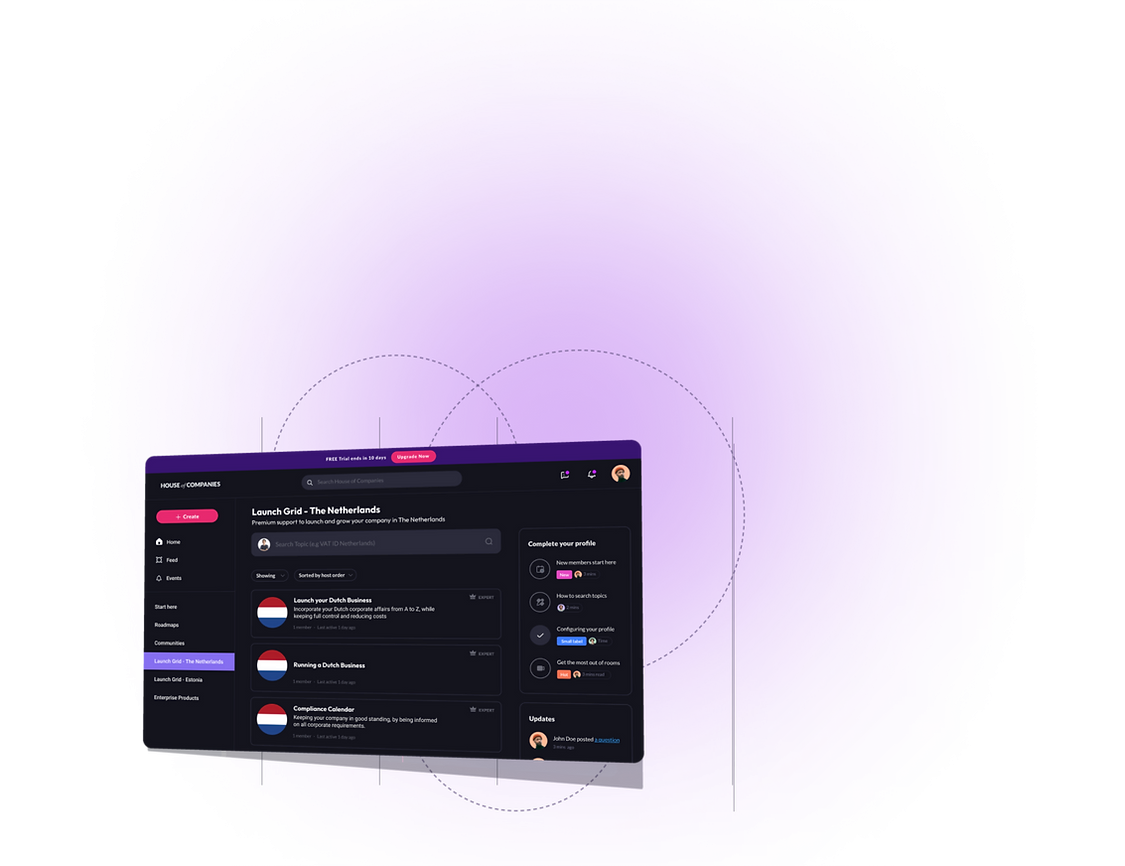

The process of submitting and processing invoices, bank statements, and even agreements (such as your lease) is becoming simpler every day.

House of Companies simplifies the procedure of submitting your data using a single source for all documents, data, and reports. You can track our progress and your profits in real-time!

"I expected it to take about two quarters to generate turnover in Ireland. Thankfully, I didn’t have to spend money on an accountant in the meantime."

Global Talent Recruiter

Global Talent Recruiter"My accountant in India drafts my VAT reports and submits the return via House of Companies’ Entity Management services!"

Spice & Herbs Export

Spice & Herbs Export"The practical expertise in Entity Management made me confident to become more involved in my own tax filing! And it worked!"

IT firm

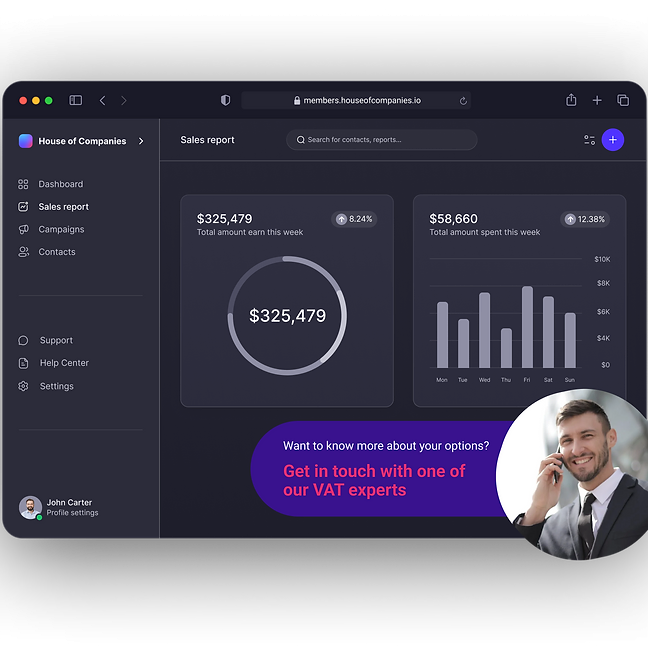

IT firmEven with the ever-changing landscape of tax and accounting regulations, there are times when your situation may require the support of a local tax professional. In Ireland, a local accountant may be required to ensure compliance with Irish laws.

If you need assistance filing your tax return, House of Companies is here to support you. You can either send us your existing ledgers and VAT analysis or instruct us to create new ones from scratch.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!